At this time last year, those working along the cold chain were collectively trying to figure out how to navigate daily—sometimes hourly—changes and disruptions to business in the middle of a pandemic. Today, as the pandemic wanes in the U.S., a new set of challenges exist, but the industry is better prepared and positioned to overcome many of those obstacles, having rapidly evolved their operational strategies in the coronavirus crucible last year. Overall, as you’ll see below, the cold chain looks robust at the mid-point of 2021.

Also, for a deeper dive into the forecast for frozen foods by AFFI, and for comprehensive research on plant-based proteins courtesy of ADM, be sure to read our State of the Industry subsections by clicking the links below.

Strong Sales for Cold Foods

“Our retail sales grew 150% during the pandemic, and while this year may not be 150% year-over-year again, it’s still growing between 40% and 50%. Also, foodservice is a large part of our operation, and that’s coming back this year,” says president & CEO of Devanco Foods, Peter Bartzis.

Devanco’s outlook could be a microcosm of what to expect for cold foods companies the rest of 2021 and into 2022. As expected, with pandemic restrictions fading and the general population increasing their mobility for work and leisure, sales of refrigerated and frozen foods are normalizing from the record-setting heights of 2020, but much of that momentum has carried through to 2021, as a combination of new customers, new buying habits, and e-commerce/direct-to-consumer options are fueling demand for cold foods.

According to statistics from the National Frozen & Refrigerated Foods Association (NFRA) and Nielsen, by the start of May 2021, retail refrigerated food sales were up +7.3% compared to May 2020, after finishing last year at +13.3%. Frozen foods sales were at +12.1% this May, after finishing 2020 at +20.4%.

Translated to dollars, frozen foods are holding steady year-over-year at approximately $67 billion with 17 billion units sold, while refrigerated foods are around $82 billion and 28 billion units sold. Unit sales for cold foods overall in 2021 are down slightly compared to the end of 2020—about -191 million for refrigerated, and -171 million for frozen—so the comparable dollars in sales can likely be attributed to inflation and a rise in food prices, which may continue through the end of 2021.

Market research firm IRI summed up the outlook for cold foods in a recent report: “At-home consumption remains elevated due to lingering stay-at-home behaviors, and as mobility improves, this elevation may erode but will remain higher compared to pre-COVID-19 levels.”

Seafood--both refrigerated and frozen--saw giant leaps in demand and sales last year that continue into 2021. Chart courtesy of IRI Q1 2021 Emerging Growth Pockets. (Click on image to enlarge.)

Seafood--both refrigerated and frozen--saw giant leaps in demand and sales last year that continue into 2021. Chart courtesy of IRI Q1 2021 Emerging Growth Pockets. (Click on image to enlarge.)

Supply Chain Struggles

A shortage of ingredients to make cold foods is just one aspect of a supply chain currently in flux—and contributing to the inflation mentioned earlier—with stops and starts of product flow amplified by events like the blockage of the Suez Canal earlier this year, plus an ongoing backup of cargo ships at U.S. ports along with a shipping container shortage. Other factors include a perpetual labor crisis in the industry, particularly with truck drivers and logistics personnel to move products from point to point.

“It’s still increasingly difficult to buy and source ingredients as costs are going up. Our lead times have doubled or tripled in some cases, making it difficult to schedule production, so all of this is a perfect storm for increasing costs that, unfortunately, will eventually be passed on to consumers,” says Lauren Edmonds, president of the Refrigerated Foods Association (RFA) and VP of R&D and marketing at St. Clair Foods, on a recent Cold Corner podcast.

“For instance,” Edmonds continues, “corn starch has been difficult to get, and the market has been unstable for oils, which we use for our mayonnaise products, so the costs are skyrocketing. Either it’s an ingredient we’re purchasing that’s been difficult to get, or our suppliers are having difficulty sourcing what they need. It’s a snowball effect that’s affecting the entire industry.”

Increased costs for commodity ingredients like oil for mayonnaise are making it difficult for companies like St. Clair Foods to maintain production schedules and budgets for items like potato salad. Images courtesy of St. Clair Foods.

Increased costs for commodity ingredients like oil for mayonnaise are making it difficult for companies like St. Clair Foods to maintain production schedules and budgets for items like potato salad. Images courtesy of St. Clair Foods.

Evolving e-Commerce

The pandemic has been called the great accelerator for its effect on speeding the evolution of the cold chain by years within a matter of weeks in 2020, and what was already growing from an e-commerce standpoint prior to COVID-19 has emerged as a dominant force for delivering cold foods today. Numerous startup food companies are debuting their products as direct-to-consumer delivery before securing retail partnerships (or bypassing retail entirely) and consumer-buying habits developed during the pandemic have made it commonplace to order perishable foods delivered to a doorstep.

According to research by real estate firm Coldwell Banker Richard Ellis (CBRE) and Forrester, e-commerce demand for cold foods currently outpaces nearly every other product for home delivery in terms of growth. Refrigerated food sales via e-commerce were at +84% last fall, compared to +54% pre-pandemic, while frozen foods were at +74% vs. +63%, respectively.

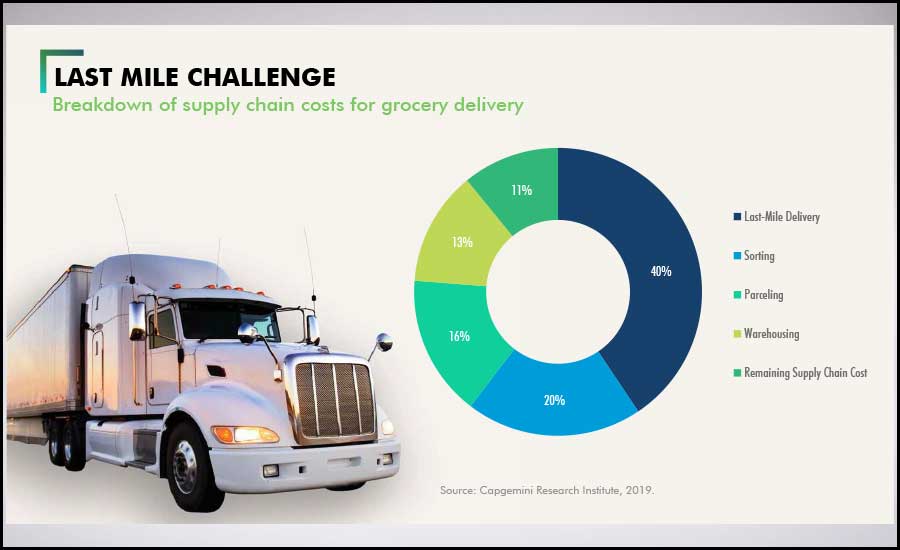

These continued gains, of course, leads to an increased reliance on last-mile delivery, impacted by the current shortage of truck drivers and personnel to fulfill those orders. Some companies are experimenting with autonomous vehicle delivery to execute those last-mile obligations, but we’re still a long way from self-driving drop-offs easing the labor crunch.

Another evolving area related to e-commerce is sustainable packaging for cold foods. Processors—particularly new brands—are trying to balance environmental responsibility with their own bottom lines, since sustainable packaging can sometimes be more expensive than traditional cold foods carriers like Styrofoam and frozen gel packs. With shipping costs increasing and some delivery delays inevitable, sustainable packaging needs to hold the cold, so to speak, beyond a single day, since thawed product can be disastrous to a budding brand’s reputation and their direct-to-consumer ambitions.

According to research by CBRE and Forrester, e-commerce demand for cold foods outpaces nearly every other product for home delivery in terms of growth, increasing the need for last-mile deliveries. Chart courtesy of CBRE Food on Demand June 2021. (Click on image to enlarge.)

According to research by CBRE and Forrester, e-commerce demand for cold foods outpaces nearly every other product for home delivery in terms of growth, increasing the need for last-mile deliveries. Chart courtesy of CBRE Food on Demand June 2021. (Click on image to enlarge.)

Cold Storage Demand

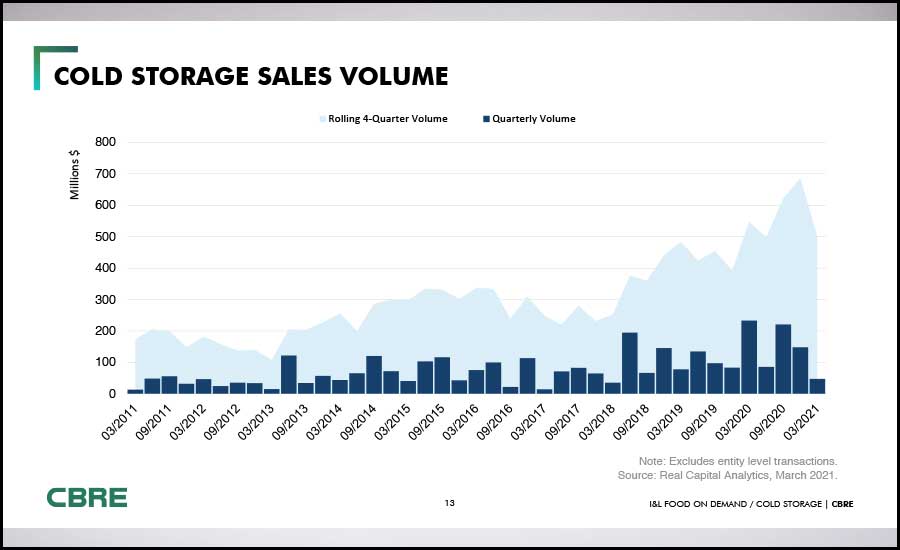

According to CBRE, the current inventory for retail cold storage is approximately 300 million square feet (MSF), while industrial cold storage is around 215 MSF. Higher consumer demand for cold foods, combined with growing e-commerce options, and the need for additional warehouses to fulfill last-mile deliveries, continue cold storage’s hot streak started last year.

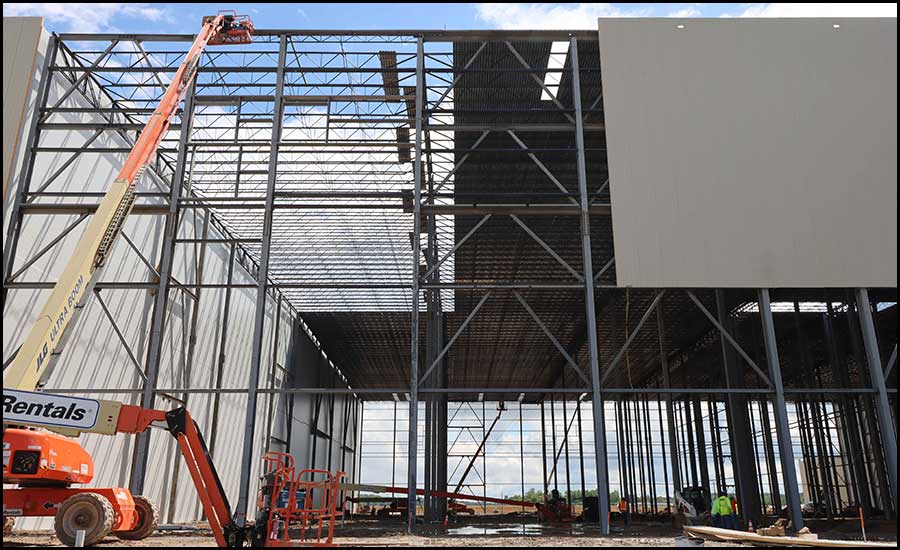

“The current outlook for cold storage is strong based on limited vacancy and increased demand for frozen and refrigerated products in nearly all core, secondary and tertiary markets. Demand drivers for storage stem from lack of new-build projects, an increasing U.S. population, the trend toward home delivery, and the need for additional inventory to protect against supply chain disruptions,” explains Brian Niven, managing director at Karis Cold. “Several factors have led to where we are today. One significant challenge is the existing inventory of U.S. cold storage facilities has an average age of 40 years or more. These aging facilities lack the efficiencies of modern construction and operations. The complexity and diversity of these facilities, along with the capital expense required to build, has led to demand outpacing supply across U.S. markets.”

Owners of new-build and existing cold storage facilities are increasing their investment in automation as an option to help alleviate the labor crisis, increase efficiencies, and put existing employees into less physically demanding positions where their operational expertise and strategic decision-making become broader assets to a company.

CBRE estimates the current inventory for retail cold storage is approximately 300 million square feet (MSF), while industrial cold storage is around 215 MSF. Photo courtesy of Tippmann Group.

CBRE estimates the current inventory for retail cold storage is approximately 300 million square feet (MSF), while industrial cold storage is around 215 MSF. Photo courtesy of Tippmann Group.

“The current outlook for cold storage is strong based on limited vacancy and increased demand for frozen and refrigerated products in nearly all core, secondary and tertiary markets," says Brian Niven, managing director at Karis Cold. Chart courtesy of CBRE Food on Demand June 2021. (Click on image to enlarge.)

“The current outlook for cold storage is strong based on limited vacancy and increased demand for frozen and refrigerated products in nearly all core, secondary and tertiary markets," says Brian Niven, managing director at Karis Cold. Chart courtesy of CBRE Food on Demand June 2021. (Click on image to enlarge.)

Foodservice Returns

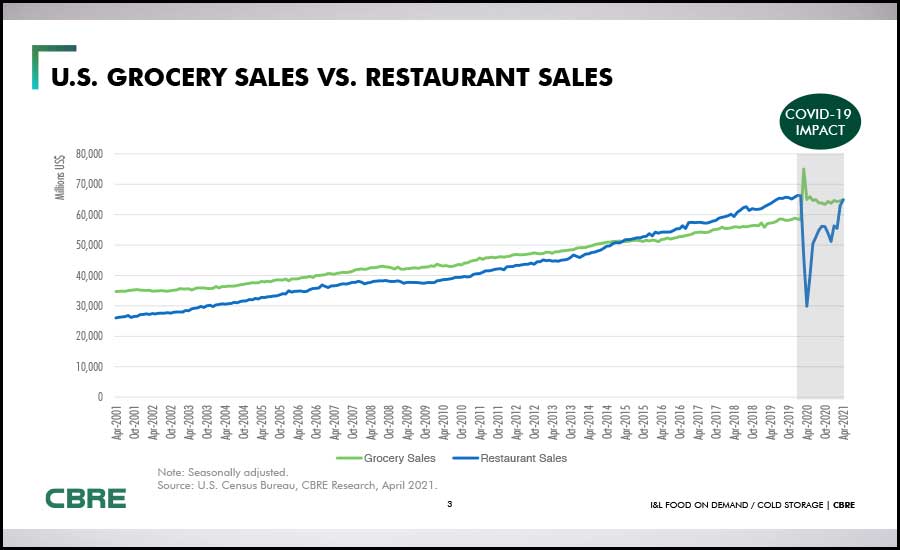

As Bartzis mentioned at the beginning of this story, foodservice is finally back, as most pandemic restrictions for on-premise dining in restaurants, hotels, catering halls, sports stadiums, and other volume venues have been lifted at the mid-point of 2021.

One of the industry lamentations of 2020 was that approximately 30% of total food sales were wiped out when COVID-19 led to a foodservice shutdown. Today, that lamentation has turned into exaltation, as the industry will likely see a 30% increase or more in food sales year-over-year by adding foodservice back to the mix. Combined with continued momentum for retail refrigerated and frozen foods, plus the ongoing rise of e-commerce/direct-to-consumer sales, the cold chain is set up for success as we enter the second half of 2021.

Foodservice sales actually outpaced grocery sales every year since 2016 until the pandemic in 2020. Foodservice is poised for a comeback this year due to pandemic restrictions being lifted for on-premise dining in restaurants, sports stadiums, event spaces, and other high-volume venues. Chart courtesy of CBRE Food on Demand June 2021. (Click on image to enlarge.)

Foodservice sales actually outpaced grocery sales every year since 2016 until the pandemic in 2020. Foodservice is poised for a comeback this year due to pandemic restrictions being lifted for on-premise dining in restaurants, sports stadiums, event spaces, and other high-volume venues. Chart courtesy of CBRE Food on Demand June 2021. (Click on image to enlarge.)

2021 State of the Industry: Plant Proteins

As a greater share of consumers experiment with the flexitarian lifestyle, they are proactively seeking more plant-forward dairy and meat alternatives to add to their diet. Many are even pursuing specific plant protein sources. In fact, ADM Outside Voice research shows that the type of plant protein in an application is important to 88% of global plant consumers and 92% of U.S. plant consumers. Consumer perceptions vary on factors like the taste and quality of plant proteins and are often connected to their awareness of a protein and their expectations of ingredient labels. For instance, nuts and seeds are perceived most positively in terms of nutrition and taste, with beans coming in a close second, while lesser-known niche protein sources have lower perception levels1.

Soy is one of the best-known plant proteins, with 75% of global plant protein consumers reporting awareness and 47% reporting consumption of soy1. Around the world, soy is the plant protein used most often in global new product launches in the alternative meat category, with wheat as a distant second. Nonetheless, wheat is among the mainstream plant-based proteins, with 59% of global consumers aware of this protein type and 39% reporting wheat consumption1.

As a greater share of consumers experiment with a flexitarian lifestyle, they're proactively seeking more plant-forward dairy and meat alternatives to add to their diet. Photos courtesy of ADM.

As a greater share of consumers experiment with a flexitarian lifestyle, they're proactively seeking more plant-forward dairy and meat alternatives to add to their diet. Photos courtesy of ADM.

Other protein sources have seen a strong increase in the global market recently, including pea protein, quinoa and chickpea1. In the U.S., pea, quinoa, brown rice and linseed are gaining ground for use in alternative meat products1. Pea protein has a 46% rate of consumer awareness and global consumption is currently at 21%1. Plus, the use of pea protein in new alternative meat launches has grown by 297% and has increased by 127% for dairy alternatives in the past five years.1 This growth is likely because brands are looking to new allergen label–friendly protein sources or for additional sources of functional proteins.

As the plant-based landscape matures, combining plant proteins is a viable way to improve taste, texture, color and nutritional profile in an application while also achieving dietary and plant diversity. ADM research shows that 68% of flexitarians prefer a mix of two or more plant proteins in alternative meats, and 52% prefer a blend in dairy alternatives. Additionally, consumers have a higher affinity for combined proteins and are willing to pay a premium price for these products1.

ADM research shows 70% of global plant consumers cite taste and nutrition as equally important to them, which means plant-based processors can't rely on clean labels alone to boost their sales. Photos courtesy of ADM.

ADM research shows 70% of global plant consumers cite taste and nutrition as equally important to them, which means plant-based processors can't rely on clean labels alone to boost their sales. Photos courtesy of ADM.

With greater access to plant-based offerings, many consumers expect alternative food and beverage products to imitate the “gold standard” of traditional meat and dairy offerings. The sensory experience, including aroma, appearance, taste, texture, functionality and cooking attributes, is critical for acceptance of plant-based alternatives. This has been a challenging consumer barrier within the plant protein market. According to ADM research, 50% of U.S. flexitarian consumers agree that meat alternatives need taste improvements, and more than 20% say that texture needs to be improved1. What’s more, 70% of global plant consumers report taste and nutrition as equally important1.

Product developers can deliver on these expectations with quality plant-based ingredients that are combined for an optimal sensory experience and enhanced nutrition. For example, pea protein and pulses together can provide the opportunity for higher protein content and plant protein diversity and are wholesome inclusions in plant-forward products. Specific processing methods can help improve water absorption for higher functionality and provide a cleaner taste and more neutral color. Rigorous quality control in processing ensures consistency in taste and function of wheat and soy proteins as well. On top of that, flavor and masking solutions can be tailored to the unique proteins and blends in an application. Technologies that deliver nutritional and functional solutions are complemented by those that yield exceptional taste.

With greater access to plant-based offerings, many consumers expect alternative food and beverage products to imitate the “gold standard” of traditional meat and dairy offerings. Photos courtesy of ADM.

With greater access to plant-based offerings, many consumers expect alternative food and beverage products to imitate the “gold standard” of traditional meat and dairy offerings. Photos courtesy of ADM.

The alternative protein market is headed in a variety of directions as formulators work to meet evolving consumer demands. As an example, there will be a greater need for plant protein-forward offerings to have additional functional claims, such as being fortified with fiber and gut microbiome-supporting ingredients. This is already true for alternative dairy products like yogurt and milks and will certainly be an opportunity in plant-based meat and seafood. Additionally, the persistent demand for clean and clear ingredient labels will not subside. Innovations are continually refining alternative protein solutions, and this will only expand as new formats emerge among plant protein-forward offerings. New processing technology is allowing for a greater variety of textures, which presents a new assortment of proteins that can be replicated and brought to market.

Surveys show 50% of U.S. flexitarian consumers agree that meat alternatives need taste improvements, and more than 20% say that texture needs to be improved before they can truly replicate traditional animal proteins like the ones above. Photos courtesy of ADM.

Surveys show 50% of U.S. flexitarian consumers agree that meat alternatives need taste improvements, and more than 20% say that texture needs to be improved before they can truly replicate traditional animal proteins like the ones above. Photos courtesy of ADM.

Another area ripe for growth lies with fermentation and new technologies like 3D printing. In fact, ADM research finds that 75% of consumer conversations around lab-based foods are focused on meat1. Scientific advancement spurs innovation, and it will be interesting to see how consumers respond to more inventive dairy and meat alternatives.

A final consideration for product developers is both availability and cost of their selected protein. As new proteins gain more traction in the marketplace, economies of scale should allow for higher use in products that can be marketed to consumers at price points that are easier to digest.

1ADM Outside Voice

Kurt Long is VP, North America, Savory Food and Global Savory Food Go To Market at Archer-Daniels-Midland (ADM).

2021 State of the Industry: Frozen Foods

The frozen food aisle has been a growth driver for retailers since 2016 with acceleration ahead of most other departments. In 2020, frozen foods proved to be a pandemic powerhouse ringing in $65.1 billion in retail sales. One of the biggest questions coming out of 2020 was whether frozen foods could sustain those gains and maintain momentum. The answer at the mid-point of 2021 is YES!

Consumers Invested

The 2021 Power of Frozen, commissioned by the American Frozen Food Institute (AFFI) and conducted by 210 Analytics, found that 30% of Americans expanded their freezer capacity by adding a second fridge/freezer combination or a stand-alone freezer since the onset of the pandemic. This was a result of one of the most consistent and persistent pandemic grocery shopping trends of fewer, but bigger trips. Preparing many more meals at home highly favored frozen food and its longer shelf life — prompting consumers to invest in additional freezer space.

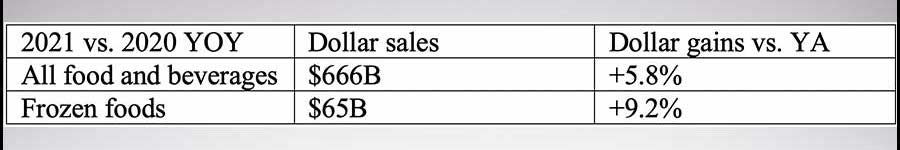

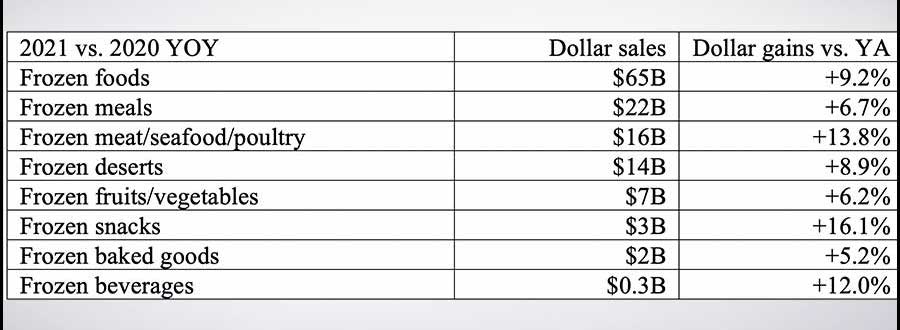

Not letting their investment go to waste, consumers continue to engage with the frozen food aisles at a high level. Over the latest 52 weeks ending in late May 2021, frozen food sales are still up 9.2% versus the same period a year ago, versus 5.8% for all foods and beverages. When shortening our performance look to just May of 2021, frozen foods were still 22.6% over and above their 2019 pre-pandemic baseline. This is still much higher than the +14.8% for total food and beverages. Across all 2021 months to date, frozen food gains have consistently been above 20% versus 2019, with matching unit and volume gains.

Source: IRI, MULO, 52 weeks ending 5/30/2021

Source: IRI, MULO, 52 weeks ending 5/30/2021

Every brand, product or category has three ways to increase sales: having more people buy, having people buy more, and having people buy more often. Recent frozen food sales have been driven by all three factors. Photo [kupicoo]/[iStock / E+] via Getty Images

Every brand, product or category has three ways to increase sales: having more people buy, having people buy more, and having people buy more often. Recent frozen food sales have been driven by all three factors. Photo [kupicoo]/[iStock / E+] via Getty Images

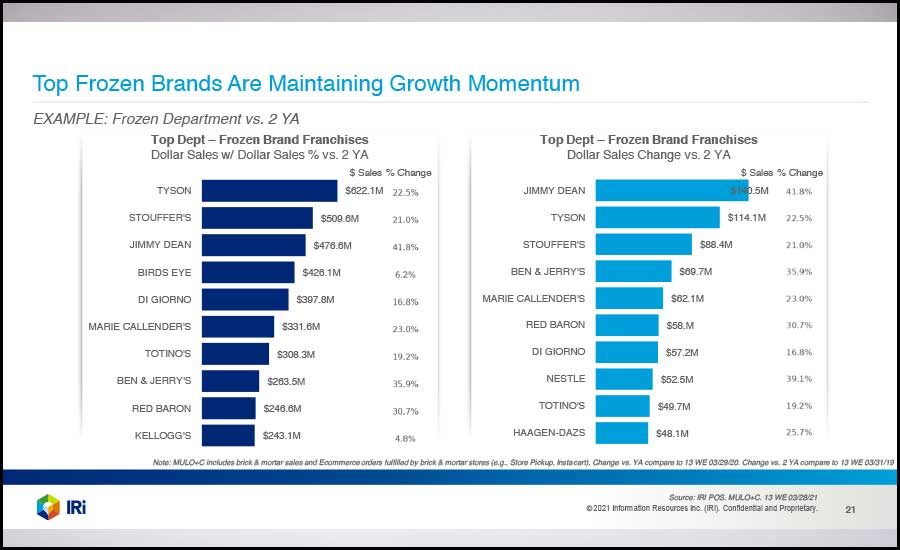

Several established frozen food brands have seen skyrocketing sales and growth since 2019. Chart courtesy of IRI Q1 2021 Emerging Growth Pockets. (Click on image to enlarge.)

Several established frozen food brands have seen skyrocketing sales and growth since 2019. Chart courtesy of IRI Q1 2021 Emerging Growth Pockets. (Click on image to enlarge.)

It is important to note that many areas of the store see their sales growth percentages boosted by high levels of inflation whereas frozen food prices are holding the line or are even slightly less than they were in the late spring of 2020. That begs the question, what is driving this enormous strength of frozen foods? Here are a few of the growth drivers that prove the demand for frozen food will remain:

- Cross-Assortment Engagement — Looking at sales patterns of the past few years, it isn’t just one or two areas in the frozen food aisle that are driving growth; it’s quite literally all categories. Certainly, there are powerhouses that have come on very strong in the past year, particularly frozen seafood and meat, but all areas gained and gained big.

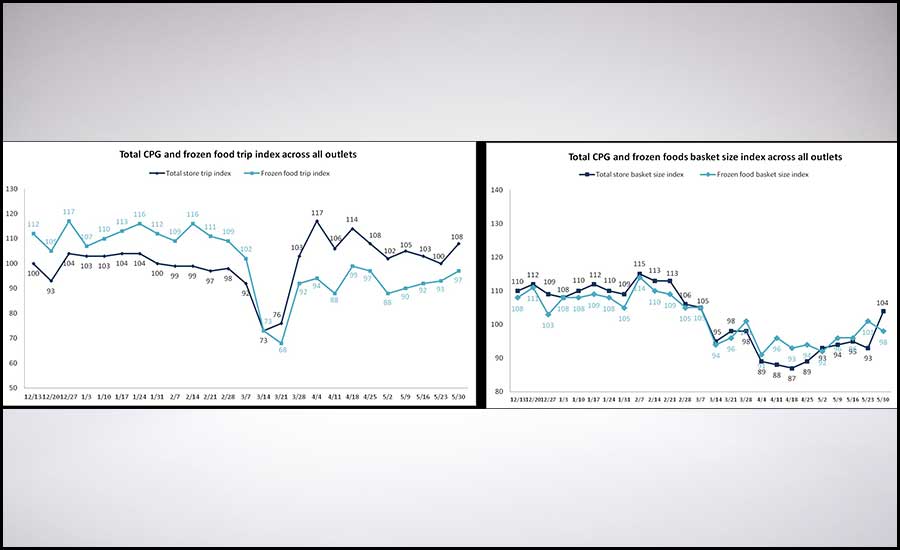

- The Three Levers of Growth —Every brand, product or category has three ways to increase sales: having more people buy, having people buy more, and having people buy more often. Frozen food sales gains are the result of hitting this growth trifecta. Virtually every frozen food category saw an increase in household penetration, trips and the average basket size—an accomplishment not all departments can boast.

- The 360 Win — Many categories play in breakfast versus dinner, or indulgence versus health. However, frozen foods cover it all: functional and indulgence plus all meal occasions from breakfast, lunch and dinner to beverages, snacks and desserts. Lunch became a huge growth opportunity during the pandemic as consumers emphasize time and convenience. With many more consumers continuing to work from home part or all of the time, frozen foods will continue to make inroads across meal occasions.

- Online Food and Beverage Growth — While all retail channels gained over the past 15 months, it was food e-commerce that exploded, with a 2020 gain of 84%, according to IRI. Online now represents about 10% of all food sold in the U.S., and online growth has not yet plateaued with expected market penetration of about 12% by the end of 2021. Here too, frozen food rides a growth trend, with very high online conversion and penetration.

In spring of 2020, consumers took significantly fewer trips while spending 10%-15% more each visit. Frozen foods experienced an increase in trips hand-in-hand with an increase in spending, since many pandemic shoppers focused on buying foods with a longer shelf life, like frozen. Chart courtesy of IRI/210 Analytics May 2021 Frozen Update. (Click on image to enlarge.)

In spring of 2020, consumers took significantly fewer trips while spending 10%-15% more each visit. Frozen foods experienced an increase in trips hand-in-hand with an increase in spending, since many pandemic shoppers focused on buying foods with a longer shelf life, like frozen. Chart courtesy of IRI/210 Analytics May 2021 Frozen Update. (Click on image to enlarge.)

Source: IRI, MULO, 52 weeks ending 5/30/2021

Source: IRI, MULO, 52 weeks ending 5/30/2021

The list of growth drivers could continue but the bottom line is that all signs point to a bright future for frozen food demand. To learn more about how CPG manufacturers and retailers can leverage the current state of the frozen food department to continue driving growth and meet consumers’ evolving needs, join AFFI and IRI on Tuesday, August 3, 2021 for a strategy-focused webinar. For details and registration, click here.

Adrienne Seiling is senior VP of strategic communications at AFFI.