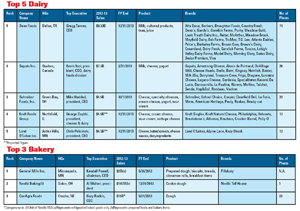

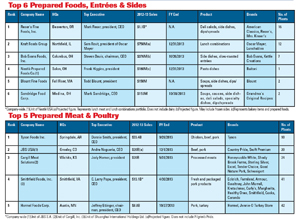

Refrigerated & Frozen Foods compiled a list of Top 25 refrigerated foods processors, broken down by category (prepared foods/entrées/side dishes, prepared meat and poultry, dairy, bakery and fruits/vegetables). Processors are ranked by annual net sales and listings.

This report represents Refrigerated & Frozen Foods’ best efforts to reflect pertinent sales from all refrigerated channels. Sales figures and estimates are based on company reports, news releases, market analysts’ reports, industry media and more.

Figures exclude shelf-stable products, but may include non-refrigerated sectors, as some companies do not track refrigerated sales out separately from frozen. Bag salad sales exclude raw produce. Prepared foods sales include prepared dishes and salads. Fruits and vegetables exclude juice.

Here are some quotes from leading refrigerated foods processors:

We recently celebrated 25 years of proudly making Nestlé Toll House refrigerated cookie dough and Buitoni refrigerated pasta and sauces at our Danville, Va., ‘big kitchen,’” says Roz O’Hearn, spokesperson for Nestlé USA, Solon, Ohio.

“The partnerships we forge with our customers, as well as the investments we have made in the last few years—and continue to make—are fueling strong growth here at Blount Fine Foods,” says Bob Sewall, vice president of sales and marketing for the Fall River, Mass., company. “In 2014, we will continue to leverage our state-of-the-art production facilities and the trust and goodwill of our customer base to expand across branded and private label retail and in foodservice.”

“Our partnership [with Shuanghui International] ensures the stability of our business for all our stakeholders, particularly our employees and the communities we serve, while simultaneously unlocking exciting opportunities for growth in the large and rapidly growing Chinese pork market,” says Larry Pope, chief executive officer of Smithfield Foods, Inc., Smithfield, Va. “This is a new era for Smithfield, but one that will continue to be defined by the strictest adherence to the highest standards of food safety and quality, an unwavering commitment to giving back to our communities and acting as a responsible global corporate citizen.”

“There have been some very encouraging developments for the U.S. animal protein sector in 2013, including expanded U.S. beef access to Japan, downward pressure on feed prices due to milder weather and a large corn crop, strong global demand and the prospect of opening or re-opening trade with several key nations. Conversely, the lingering impact of U.S. drought forced us to idle a large beef plant in the Texas panhandle and continues to manifest itself in higher-than-usual protein prices for consumers. Also, some public policy decisions such as country of origin labeling are driving up costs, increasing complexity for food producers and retailers while confusing consumers. Nevertheless, consumer research we have conducted over the past year or so indicates there is a strong desire by consumers for affordable animal protein as part of their diets, as well as a desire for greater variety. We believe our animal protein business will thrive because we are focused on finding marketplace solutions to meet the needs of consumers and help our customers grow their meat business,” says Jody Horner, president, Cargill Meat Solutions, a Wichita, Kan.-based unit of Cargill, Inc.

Noteworthy Events

Here’s a rundown of the comings and goings of some of the industry’s biggest players.

- In the beginning of 2013, Dean Foods completed its sale of the Morningstar Foods division to Saputo Inc.

- Also earlier last year, ConAgra Foods acquired Ralcorp Holdings.

- In February 2013, Tyson Foods and its subsidiary Tyson Mexican Original acquired Don Julio Foods. Then in June 2013, Tyson acquired Circle Foods, LLC.

- In May 2012, Bob Evans Foods announced its intention to close food production plants in Springfield and Bidwell, Ohio.

- Land O’Lakes officially integrated the Kozy Shack business it acquired in August 2012.

- On April 1, 2013, Dole’s worldwide packaged foods and Asia fresh produce businesses were sold to ITOCHU Corp.

- In June 2013, Sandridge Food Corp. purchased RMH Foods.

- In July 2013, Dean Foods completed its spin-off of The WhiteWave Foods Co.

- In September 2013, Smithfield Foods merged with Shuanghui International Holdings Ltd.

- At the end of 2013, Dole Food’s chairman David Murdock completed his acquisition of the company, making it a privately-held company.

- As of press time, WhiteWave Foods announced plans to purchase Earthbound Farm.

|

|

|