According to the Chinese New Year, 2012 is the year of the dragon, but for many in the refrigerated and frozen foods industry, it was the year of change. From mergers and acquisitions to buyouts and sell-outs to promotions and resignations, the refrigerated and frozen foods industry experienced a great deal of change. Big companies gobbled up other big companies to become bigger. CEOs moved amid the marketplace. Brands remained tried and true, but changed ownership.

Some companies even managed to grow their bottom line, while others shut down plants just to stay out of the red.

This is Refrigerated & Frozen Foods’ 15th annual Top 150 Food Processors report, and you’re invited to read on and learn more about these developments.

ABOUT THIS REPORT

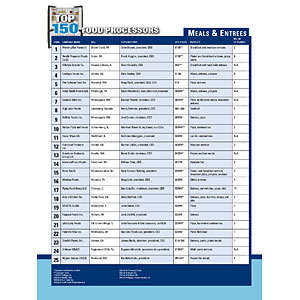

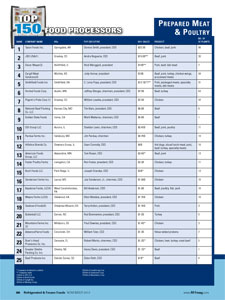

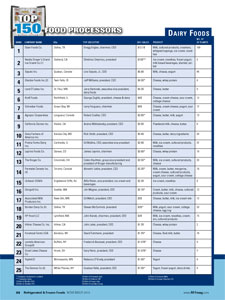

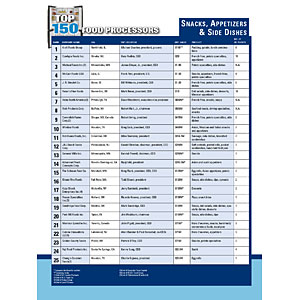

Refrigerated & Frozen Foods’ 15th annual industry leaders report profiles the Top 25 processors in each of the six refrigerated and frozen food sectors. Processors are ranked by annual net sales and listings.

Some refrigerated and frozen foods processors declined to provide annual sales or refused to update company information. This report represents Refrigerated & Frozen Foods’ best efforts to reflect pertinent sales from all channels. Sales figures and estimates, which are marked with an asterisk (*), are based on company reports, news releases, market analysts’ reports, industry media and more. Figures exclude shelf-stable products.

A special thank you goes to Refrigerated & Frozen Foods’ sister publications—National Provisioner, Dairy Foods and Snack Food & Wholesale Bakery—for their research and support for the further processed meat, dairy foods and bakery sections, respectively. And of course thank you to all of the respondents for taking the time to update their company information. Going straight to the source is a million times more credible than pulling information from the internet, so for that, we appreciate your cooperation.

Next year, we’re taking this report and breaking it up by refrigerated vs. frozen foods processors. Keep an eye out for a more in-depth look at the major players in the refrigerated foods category in our Top 25 Refrigerated Foods Processors feature (January 2013 issue) and our Top 150 Frozen Foods Processors (February 2013).

CATEGORIES

MEALS & ENTREES (PAGE 28)

Includes refrigerated and frozen breakfasts and breakfast entrees, hand-held entrees and sandwiches, bagged meal kits, pizza, pasta, plated dinner meals, pot

|

pies, meatless entrees and prepared seafood entrees.

PREPARED

MEAT & POULTRY (PAGE 30)

Includes fresh and processed beef, poultry, pork and lamb.

DAIRY (PAGE 32)

Includes milk, butter, cultured products, ice cream, novelties, natural and processed cheese, dairy-based spreads and toppings.

SNACKS, APPETIZERS & SIDE DISHES (PAGE 34)

Includes refrigerated and frozen prepared snacks, appetizers, hors d’oeuvres, soups, side dishes, deli-style salads, potato products, prepared gelatins, puddings and soft pretzels.

BAKERY (PAGE 36)

Includes refrigerated and frozen breads, rolls, bagels, biscuits, cakes, pies, Danish and cookies available in dough, par-baked and fully baked forms.

FRUITS & VEGETABLES

(PAGE 38)

Includes processed fruit and vegetables and prepared fresh-cut salads.

CHANGE OF HANDS

When it comes to the food processing world, nothing is ever what it seems. One minute, Unilever North America is a global powerhouse of frozen meals; the next, it’s selling off its frozen meals business to ConAgra Foods. Call it the changing of hands.

|

In July, the Englewood Cliffs, N.J., producer parted ways with its Bertolli and P.F. Chang’s frozen meals brands, selling them to ConAgra Foods, Omaha, Neb. According to a press release, “the company’s decision to divest its North American frozen meals business is in line with its global strategy to exit the frozen foods business.” ConAgra also purchased the Marie Callender’s trademark from Marie Callender Pie Shops Inc., Mission Viejo, Calif.

In June 2011, Cincinnati-based AdvancePierre Foods purchased Barber Foods, an Edmond, Okla.-based producer of frozen chicken entrees.

In December 2011, Centre Partners, a New York-based middle-market private equity firm, acquired Bellisio Foods Inc., a Minneapolis-based frozen foods processor. Bellisio Foods is home to more than 200 frozen meals, including the Michelina’s and Boston Market brands.

ARYZTA, LLC, a Los Angeles-based conglomerate of La Brea Bakery, Fresh Start Bakeries, Otis Spunkmeyer and frozen pizza producer Great Kitchens, Romeoville, Ill., reported a 113% increase in operating profit within the North American food segment in fiscal 2011, as a result of its merger. (Go to Bakery Foods, page 36, for more on this acquisition).

Also in December 2011, Canada-based High Liner Foods acquired Icelandic Seafood USA, Inc. and its related Asian procurement operations. As a result, High Liner closed two meat/entrée production plants, and rolled out Fire Roasters and Flame Savours, premium fish fillets created for U.S. foodservice and Canadian retailers, respectively.

BURSTING AT THE SEAMS

While some frozen food processors are buying and selling portions of their businesses, others are simply bursting at the seams.

Request Foods, Holland, Mich., launched a skillet meal co-packing program in September 2011. The new 230,000-square-foot, state-of-the-art facility is designed to complement the company’s existing pan and tray packing lines.

Meanwhile, Little Lady Foods, Elk Grove Village, Ill., showcased a newly expanded culinary center, with an R&D kitchen for product ideation, recipe development and testing/quality control as well as a showcase kitchen for presentation and customer collaboration.

From one company to two back down to one, today’s meal and entrée makers experience change of hands without disrupting the evolution of the category.

NOTEWORTHY EVENTS

June 2011—ConAgra Foods purchased the Marie Callender’s trademark.

September 2011—Request Foods built a 230,000-square-foot, state-of-the-art facility for its co-packing skillet meals business.

Little Lady Foods opened a new culinary center, complete with R&D and showcase kitchens.

November 2011—ConAgra Foods acquired National Pretzel Co. and additional equity interest in Agro Tech Foods.

December 2011—Centre Partners acquired Bellisio Foods.

High Liner Foods acquired Icelandic Seafood USA and related Asian procurement operations, including the processing plant in Newport News, Va., from the Icelandic Group of Iceland.

January 2012—Tracy Quinn, former chief financial officer of Overhill Farms, resigned, effective Feb. 24. Robert Bruning was named as her replacement.

American Seafoods Group acquired Good Harbor Fillet, and then announced plans to close the Gloucester, Mass., operation.

February 2012—Bryce Ruiz, former president and CEO of Ruiz Food Products, stepped down for “personal reasons.” Rachel Cullen took over.

July 2012—Unilever North America sold off its Bertolli and P.F. Chang’s frozen meals brands to ConAgra Foods.

October 2012—Kraft Foods separated into two companies—Mondeléz International Inc. and Kraft Foods Group.

SEAL OF APPROVAL

The past year has put the meat industry through the ringer—think pink slime. But curtailing to the ever-changing criteria of meat and poultry production doesn’t

|

have to be a battle.

Earlier this year, Sara Lee Corp. changed the name of its North American business to Hillshire Brands Co., consisting of Ball Park, State Fair, Hillshire Farm and Jimmy Dean brands. This move helped the Downers Grove, Ill., company rake in close to $4 billion in sales company-wide.

Butterball, LLC expanded its 1,300-square-foot Carthage, Mo., plant, adding 90 new jobs and a burger line that alone, is expected to churn out more than 11 million pounds of product per year.

In September 2010, Seaboard Foods, Shawnee Mission, Kan., welcomed Butterball, LLC into its family of brands after parent company Seaboard Corp. purchased 50% interest in the Garner, N.C., turkey producer.

And, Seattle-based American Seafoods Group acquired Good Harbor Fillet, LLC.

Meanwhile, Foster Poultry Farms plunged forward with new product launches—100% Whole Grain Chicken Corn Dogs for foodservice operators and school lunch programs. It also earned the Parent Tested Parent Approved (PTPA) Winner’s Seal of Approval, crowning it a new school lunch offering that parents and children agree on.

Also on the horizon for the Livingston, Calif.-based chicken and turkey processor is a new Foster Farms Poultry Education and Research Facility at the California State University, Fresno, Calif. The new facility is scheduled to open in the spring semester of 2013.

In May, Hormel Foods launched its fifth full corporate responsibility report, outlining key metrics such as reducing packaging by 4.2 million pounds; reducing water consumption by 15%; continuing to outperform the industry average for safety rates; and implementing several significant capital projects designed to reduce energy use. In July, the Austin, Minn., processor’s corporate north office expansion obtained LEED Gold certification. Hormel Foods also launched Hormel Natural Choice chicken and smoked sausages (inset), Hormel Natural Choice lower sodium breakfast Canadian bacon and Hormel Cure81 ham steaks.

Smithfield Foods, Inc. continued to match its low level injury rate company-wide. In 2011, the Smithfield, Va.-based company’s injury rate was 3.93 injuries per 100 employees, down from 4.66 injuries in 2010.

As of press time, ConAgra Foods, Omaha, Neb., announced it will be closing its Odom’s Tennessee Pride pork processing plant in Little Rock, Ark., in late spring 2013, and moving the hog processing and breakfast sausage production to Abbyland Foods in Abbotsford, Wis.

|

Whether it’s meeting—and exceeding—food safety compliance efforts or developing a host of new products, today’s meat and poultry processors continue to receive the industry’s seal of approval.

September 2010—Seaboard Farms welcomed Butterball into its family of brands.

June 2011—Keystone Foods appointed former COO Larry McWilliams as president and CEO, succeeding Jerry Dean, who retired after leading the company for 17 years.

September 2011—Butterball named Rod Brenneman president and CEO.

December 2011—National Beef Packing entered into an agreement for Leucadia National Corp. to acquire 79% of the outstanding ownership assets.

January 2012—American Seafoods Group acquired Good Harbor Fillet.

June 2012—Sara Lee changed the name of its North American business to Hillshire Brands Co.

September 2012—OSI signed ajoint venture agreement with Doyoo Group to create DaOSI, the company’s third fully integrated poultry operation in China.

October 2012—Kraft Foods separated into two companies—Mondeléz International Inc. and Kraft Foods Group.

January 2013—Andre Nogueira, former CFO and current CEO of JBS Australia, will assume the CEO role, effective Jan. 1, 2013, replacing Don Jackson, who is retiring from his president and CEO post end of this year.

Spring 2013— Foster Poultry Farms is building a Farms Poultry Education and Research Facility at California State University.

CHURNING OUT MORE THAN JUST DAIRY

The year 2011 was a period of transformation for the dairy industry. Between introducing a slew of new retail products, expanding production plants, severing off segments of the company or undergoing personnel changes, today’s dairy processors were busy churning out more than just dairy.

For instance, in July, Land O’Lakes, St. Paul, Minn., scooped up Kozy Shack Enterprises Inc., the Hicksville, N.Y., producer of pudding. (See Snacks, Appetizers & Side Dishes, page 34, for more information).

Then, Dairy Farmers of America acquired Kemps LLC from HP Hood, making it a $3.4 million company. The Kansas City, Mo., processor also broke ground on a 31.5-acre ingredients plant in Fallon, Nev., that will be equipped to process 2 million pounds of raw milk daily, and at full capacity, approximately 250,000 pounds of dried dairy ingredients daily for global and domestic customers.

Nearly a year later, Associated Milk Producers, Inc., New Ulm, Minn., sold Cass-Clay Creamery to Kemps, LLC.

In March 2011, General Mills purchased the Yoplait yogurt brand for a reported $1.2 billion, and later acquired Mountain High Yoghurt from Dean Foods.

Dean Foods remained in the No. 1 slot with $12.7 billion in sales (up from $12.1 billion last year). The Dallas-based food giant is also building a projected 287,000-square-foot plant for its WhiteWave-Alpro Foods division.

In July 2011, LALA USA changed its name to Borden Dairy Co., a subsidiary of Grupo LALA. The business unit controls all functions, including manufacturing and

|

distribution of the LALA, La Creme, Frusion and Weight Watchers brands.

In September 2011, The Dannon Co. opened a $9 million research and development center at its White Plains, N.Y., headquarters, with plans to move its Fort Worth, Texas, pilot plant to this new facility. The center contains state-of-the-art manufacturing equipment, a sensory and consumer insights lab, a quality analysis lab and a laboratory for fruit and flavors.

Glanbia Foods, Twin Falls, Idaho, initiated construction on a state-of-the-art Cheese Innovation Center and corporate headquarters. The $15 million, three-story, 35,000-square-foot office complex and 14,000-square-foot research center are slated to open in spring 2013.

In May, Italian dairy giant Parmalat S.p.A. acquired its sister unit Lactalis American Group, Inc., Buffalo, N.Y. Both groups are owned by French dairy producer Lactalis.

In October, Kraft Foods completed the spin-off of its North American grocery business, Kraft Foods Group, Inc., and distributed all outstanding shares of Kraft Foods Group common stock to its shareholders on Sept. 19. Concurrent with the spin-off, the Northfield, Ill.-based company changed its name to Mondeléz International, Inc.

As of press time, Kraft is reporting to sell its Breakstone’s sour cream and cottage cheese unit to Grupo LALA. Reports also say that Grupo LALA is seeking to acquire Morningstar Foods, a milk line currently owned by Dean Foods.

It takes more than just milk to keep ahead of the competition. Thankfully, today’s dairy processors maintain position in the industry by churning out more than just dairy.

April 2011— Dairy Farmers of America acquired Kemps from HP Hood.

July 2011—LALA USA changed its name to Borden Dairy Co.

General Mills acquired Yoplait and Mountain High Yoghurt.

August 2011—Leprino Foods opened an innovation studio in Singapore.

September 2011—Dannon opened an R&D center at its New York headquarters.

March 2012—Associated Milk Producers sold Cass-Clay Creamery to Kemps.

July 2012—Land O’Lakes scooped up Kozy Shack Enterprises.

October 2012—Kraft Foods separated into two companies—Mondeléz International Inc. and Kraft Foods Group.

Spring 2013— Glanbia Foods is slated to open a Cheese Innovation Center.

|

SPENDING MONEY TO MAKE MONEY

Americans keep complaining, “bad economy,” “we’re in a recession,” “we’re cutting back.” However, from the looks of the food industry’s rap sheet, it seems as though producers of snacks, appetizers and side dishes didn’t get the memo.

For example, in February 2011, Windsor Foods, Houston, Texas, and San Francisco-based Friedman Fleischer & Lowe purchased Discovery Foods, a manufacturer of frozen Asian snacks, appetizers and entrees based in Hayward, Calif.

New to the scene Fuji Food Products, a Santa Fe Springs, Calif., sushi producer, acquired Okami, Inc., a manufacturer of premium gourmet ethnic meals.

In May 2011, GS Capital Partners took over Michael Foods, Inc., Minnetonka, Minn., and its parent company, M-Foods Holdings, Inc.

In August 2011, Blount Fine Foods acquired Neco Foods, LLC, Lantana, Fla. Then, in December 2011, it obtained Cape Cod Chowder Co., Marion, Mass.

In November 2011, Reser’s Fine Foods, Beaverton, Ore., purchased Orval Kent Foods Co. after the Wheeling, Ill., food processor and its parent company Chef Solutions Inc. entered bankruptcy.

Then in March, Golden County Foods, Plover, Wis., sold its Chicago-based subsidiary, Appetizer’s And Inc., to Progressive Gourmet, a Wilmington, Mass., food distributor.

Earlier this year, R.A.B. Food Group, the Secaucus, N.J., owner of the Manischewitz brand, bought Cuisine Innovations, LLC, a specialty and kosher frozen foods producer headquartered in Lakewood, N.J.

In June, J&J Snack Foods Corp., Pennsauken, N.J., acquired Kim & Scott’s Gourmet Pretzels, a Chicago-based soft pretzel maker, with plans to expand the Kim & Scott’s brand.

Meanwhile, Land O’Lakes scooped up Kozy Shack Enterprises Inc., the Hicksville, N.Y., producer of pudding.

In August, Bob Evans Farms Inc., Columbus, Ohio, acquired the Kettle Creations brand and its 100,000-square-foot, state-of-the-art manufacturing facility in Lima, Ohio, for approximately $50 million.

In October 2011, Sandridge Corp., Medina, Ohio, added seven new premium seafood salads and dips to its Pacific Coast Cuisine line.

McCain Foods’ Plover, Wis., facility underwent a $34 million makeover (for more on McCain Foods, check out our September 2012 issue).

This year, J. R. Simplot Co., Boise, Idaho, began construction on a 380,000-square-foot, state-of-the-art potato processing plant in Caldwell, Idaho. The plant is expected to be completed in spring 2014. J. R. Simplot is also building a new headquarters building, estimated to be 10 stories high, 300,000 square feet in size and ready to house about 900 employees. Completion is projected for late 2015 to early 2016.

Recession or not, today’s refrigerated and frozen foods processors are spending money to make money.

February 2011—Windsor Foods acquired Discovery Foods.

April 2011—Fuji Food Products acquired Okami, Inc.

May 2011—GS Capital Partners took over Michael Foods and its parent company, M-Foods Holdings.

August 2011—Blount Fine Foods acquired Neco Foods.

Claridge Food Group sold Glutino Food Group to Smart Balance.

December 2011—Blount Fine Foods obtained Cape Cod Chowder Co.

November 2011—Reser’s Fine Foods purchased Orval Kent Foods Co.

March 2012—Golden County Foods sold its subsidiary, Appetizers And Inc., to Progressive Gourmet.

May 2012—R.A.B. Food Group invested in Cuisine Innovations.

June 2012—J&J Snack Foods acquired Kim & Scott’s Gourmet Pretzels.

July 2012—Land O’Lakes scooped up Kozy Shack Enterprises.

August 2012—Bob Evans Farms acquired the Kettle Creations brand and its Lima, Ohio, facility.

October 2012—Kraft Foods separated into two companies—Mondeléz International Inc. and Kraft Foods Group.

Spring 2014—J. R. Simplot will debut its new 380,000-square-foot, state-of-the-art potato processing plant in Caldwell, Idaho.

Late 2015/Early 2016—J. R. Simplot will debut its new 300,000-square-foot headquarters.

TO THE OCCASION

For years, the bakery segment has been monopolized by made-to-order items that are served hot and fresh out of the oven.

That’s why today’s refrigerated and frozen foods producers make it so shoppers can enjoy a piping hot roll straight from the freezercase.

For instance, ARYZTA, LLC, a Los Angeles-based conglomerate of La Brea Bakery, Fresh Start Bakeries, Otis Spunkmeyer and Great Kitchens (see Meals & Entrees, page 28, for more on Great Kitchens), reported a 113% increase in operating profit within the North American food segment in fiscal 2011. The acquisition of the four companies also increased its number of U.S. bakeries from 19 to 23.

In May 2011, Gonnella Frozen Products, a division of Gonnella Baking Co., increased freezer capacity from 3 million to 4.5 million pounds through a 29,000-square-foot expansion at its Schaumburg, Ill., headquarters. The plant houses 168 employees and produces about 2.5 million pounds of frozen dough a week.

Also in May, Flowers Foods Inc., Thomasville, Ga., acquired Tasty Baking Co., a Philadelphia-based producer of Tastykake brand cupcakes. Then, in July, Flowers Foods purchased Lepage Bakeries Inc., the Auburn, Maine, owner of Country Kitchen and Barowsky’s bread lines. Today, Flowers Foods rakes in approximately $236.4 million in sales in its frozen bakery channel.

In July 2011, Wenner Bread Products, Bayport, N.Y., underwent a recapitalization, resulting in Jeff Montie taking over as chief executive officer.

In August 2011, Sara Lee Corp., Downers Grove, Ill., completed the sale of its North American refrigerated dough business to Ralcorp Frozen Bakery Products, Inc., a Downers Grove, Ill.-based division of Ralcorp Holdings. The refrigerated dough unit provides a full range of private label products, including basic and specialty biscuits, rolls, toaster pastries and pizza and pie crusts.

Then, Sara Lee changed the name of its North American business to Hillshire Brands Co., consisting of Sara Lee and Chef Pierre brands (see Prepared Meat & Poultry, page 30, for more on Hillshire Brands). This move prompted the company to soar from No. 8 to No. 5, as it raked in close to $4 billion in sales company-wide. (Hillshire Brands declined to provide incremental sales figures for the refrigerated and frozen bakery division).

Meanwhile, Turano Baking Co. jumped from the No. 23 slot last year to No. 18, raking in up to $200 million in sales, up from $110 million in 2011. The Berwyn, Ill., producer of frozen bread also celebrated its 50th anniversary this year.

New to the chart is Aunt Millie’s Bakeries, a Fort Wayne, Ind., producer of frozen buns and rolls. Aunt Millie’s achieved $210 million in sales with its Aunt Millie’s brand, among others.

In May, Superior Capital Partners, LLC, a Detroit-based private equity firm, acquired Heinz North America’s U.S. frozen premium foodservice desserts business and named it Dianne’s Fine Desserts, a provider of gourmet frozen, thaw-and-serve desserts to the foodservice industry and in-store bakeries. The purchase includes Dianne’s Gourmet Desserts, Alden Merrell Fine Desserts, Black Tie and Skooopz brands, along with their 500 employees at their Le Center, Minn., and Newburyport, Mass., bakeries.

Whether it’s the ability to expand their portfolio or increase the bottom line, today’s bakeries rise to the occasion, equipped to make an impact in the industry.

September 2010—ARYZTA purchased La Brea Bakery, Fresh Start Bakeries, Otis Spunkmeyer and Great Kitchens.

March 2011—Canada Bread Bakery Ltd., the Canada-based unit of Maple Leaf Foods, closed down its Laval, Quebec, bakery, shifting production to other facilities with available capacity.

May 2012—Heinz North America sold off its U.S. frozen foodservice desserts business to Superior Capital Partners, who re-named it Dianne’s Fine Desserts.

June 2012—Sara Lee changed the name of its North American business to Hillshire Brands Co.

September 2012—Pepperidge Farm opened a 34,000-square-foot, LEED-certified innovation center. Meanwhile, Irene Chang Britt was named president, taking over for Pat Callaghan.

WEATHERING THE STORMS

The year 2012 saw the most extensive drought in the last 25 years, according to “U.S. Drought 2012: Farm and Food Impacts,” produced by the U.S. Department of Agriculture. In fact, as of mid-August, 60% of U.S. farms were still experiencing the effects—destroyed fields and crops, heat-stressed cattle and an increase in commodity prices.

However, fruit and vegetable producers managed to weather the storms thanks to a little help from their “friends.”

In March, Canada-based Bonduelle North America took over Allens Inc., including four of Allens’ processing sites, as well as the Chill Ripe and Garden Classic brands. Allens continues to own and operate its Montezuma, Ga., facility.

J. R. Simplot Co., Boise, Idaho, flexed its spending dollars by acquiring Dorman Brothers, LLC, an agricultural supply company.

In August 2011, SunOpta Food Solutions, a Santa Cruz, Calif., division of SunOpta, acquired Lorton’s Fresh Squeezed Juices, Inc., a San Bernadino, Calif., producer of citrus-based products.

In October 2011, Dole Food Co. acquired SunnyRidge Farm, a berry producer based in Winter Haven, Fla. In March, Westlake Village, Calif.-based Dole purchased Mrs. May’s Naturals, a family-run snack producer. Then in September, Dole signed a definitive agreement with Japan-based ITOCHU Corp. for the sale of its worldwide packaged foods and Asia fresh produce businesses.

SUNNY SKIES

While some companies flourished through mergers and acquisitions, others raised the roof of their own operations to make room for upgrades and new product development.

Inn Foods, Inc. made a $3.5 million upgrade to its blending and packing facilities, putting the Watsonville, Calif.-based division of VPS Cos. in the forefront of frozen food technology. Last year, it ranked No. 22 with $80 million in sales; to date, it’s slotted as No. 16 with $155 million in sales.

Earthbound Farm introduced 15 SKUs of frozen fruits and vegetables, six herb purees in tubes and PowerGreens, a blend of baby kale, chard and spinach. As a result, the San Juan Batista, Calif., processor experienced $450 million in sales—up from $115 million last year—making it No. 8 in the sector.

GUSTY WINDS

Unfortunately, not all refrigerated and frozen fruit and vegetable producers were able to weather the storms of today’s economic meltdown.

For instance, in June, Patterson Vegetable Co. closed its doors for good, after union employees rejected cuts in benefits and wages, according to several news reports. The former 1-million-square-foot plant that towered over downtown Patterson, Calif., processed a variety of vegetables grown by independent farmers.

After experiencing a severe flood in 1990, an electrical explosion in 1996 and a fire in 1998, Twin City Foods discontinued processing and contracting peas nearly nine years later, but will keep its packaging facility at its Stanwood, Wash., headquarters, says several news reports.

Despite the challenges of the weather, the fruit and vegetable sector continues to coast through treacherous conditions to maintain its mark in the industry.

August 2011— SunOpta Food Solutions acquired Lorton’s Fresh Squeezed Juices.

October 2011— Dole acquired SunnyRidge Farm.

March 2012— Bonduelle North America took over Allens Inc.

Dole purchased Mrs. May’s Naturals.

April 2012—Superior Foods completed a $3 million expansion of its San Antonio, Texas, packaging facility.

June 2012— Patterson Vegetable Co. closed its doors.

July 2012— Lakeside Foods, Inc. celebrated its 125th anniversary.

August 2012— J.R. Simplot acquired Dorman Brothers.

September 2012—Dole bought ITOCHU’s worldwide packaged foods and Asia fresh produce businesses.

Superior Foods named Neil Happee president and CEO, while David Moore and Mateo Lettunich were appointed co-chairmen of the board of directors.