Esko, Belgium, alongside sister companies Pantone, Carlstadt, N.J.; X-Rite, Inc., Grand Rapids, Mich.; and AVT, Inc., Sandy Springs, Ga., released a new study highlighting what primary shoppers want from food and beverage packaging.

The study, "Packaging and the Digital Shopper: Meeting Expectations in Food & Beverage," outlines how brand and marketing managers, design leaders, packaging professionals and tech leaders can gain knowledge of shopper's preferences in packaging. With this knowledge they can better optimize, evolve and connect packaging through technology platforms that support end-to-end packaging value chain and leverage packaging as an enabler for product innovation.

Some statistics from the study are as follows:

• Only 0.8% of primary shoppers indicated that they have never purchased any food and beverage products online.

• 33% of those who purchase online cite convenience as a reason, and 43% of respondents say they shop online to get a better price.

• 75% of shoppers stated they foresee purchasing more snacks online in the next 18 months.

• 9% of primary shoppers say that buying these food and beverages online isn’t their first preference and they won’t purchase this way in the future.

Inside the mind of the in-store shopper

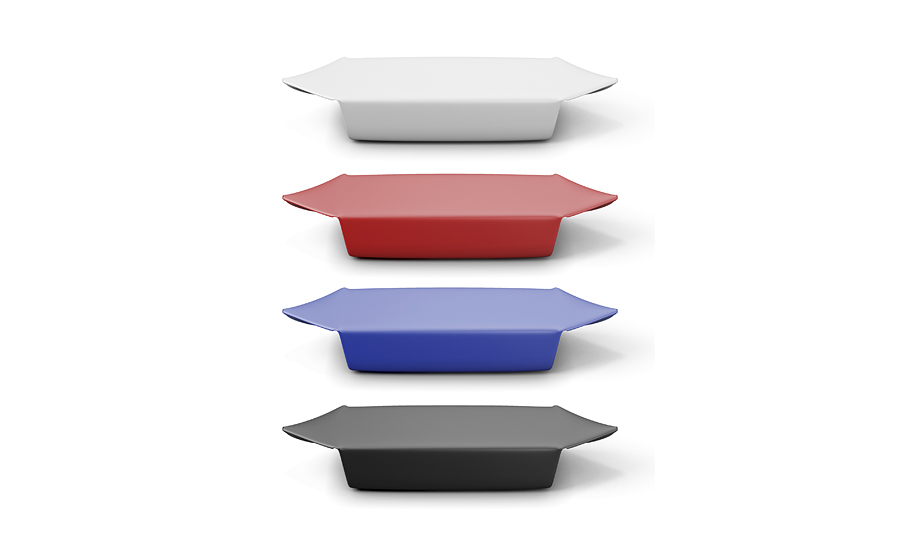

Packaging plays a role in product differentiation, on the shelf at traditional brick and mortar stores. A key in-store goal for any consumer packaged goods (CPG) company is to get the shopper to actually touch their package. The shopper is more likely to buy a product once they touch it, and how the packaging looks and feels in their hand impacts that impulse. In-store activities have a big impact on trial, with 20% of shoppers reporting that they have tried a new product specifically because of in-store taste samples or an in-store display.

Online purchases and shopper packaging expectations

Online and offline experiences must mirror each other, as primary shoppers expect nothing less from brands. Whether they are purchasing products online or pulling an item from a retail shelf, the packaging and experience should be the same.

• 47% of shoppers expect the product image to match the product packaging that arrives on their doorstep.

• Only 9% of survey respondents were okay with packaging that was a different color of pack type.

• 26% of primary shoppers who had returned product based on the packaging reported that they did so because they thought it looked wrong or was counterfeit.

“Data and insights on what shoppers like helps fuel innovative product designs with strong value propositions through packaging, but knowing how shoppers want to receive products is also critical piece of the story,” says John Elworthy, senior director of global brand sales. “Without knowing the means by which shoppers want to receive products, marketers and brand leaders risk losing out on revenue opportunities.”

“And, by connecting the packaging value chain through the latest packaging technologies, fast-moving consumer goods companies will be able to better connect to consumers and elevate their brand experiences and both pre-media and converters will better understand the product standards consumers expect and can work more seamless with brand owners to provide them,” adds Udo Panenka, president of Esko. “This helps to make packaging the enabler to satisfy consumer needs rather than being a cost driver or a headache.”