Today’s food and beverage processors and distributors face several challenges—increased food safety regulations, energy efficient initiatives, continuous new product development, mergers and acquisitions and more. But, behind the scenes lie some even more pressing challenges, such as labor shortages, undesirable working temperatures, taller buildings and warehouses, ever-changing technology and so on.

“Labor is becoming more expensive and harder to find. Accuracy and building throughput requirements are on the rise. Customers are demanding more in terms of service, not just product,” says Jason Perks, solution sales director for Viastore, Grand Rapids, Mich. “As food and beverage orders become smaller and smaller with more lines per order, the importance of accuracy will increase as well.”

And, in some cases, overcoming these challenges becomes the “cost of doing business.”

“Finding and maintaining labor is extremely hard,” says Tom Steininger, market development manager, Dematic, Grand Rapids, Mich. “We are experiencing a large number of staff reaching retirement age, a younger workforce that is not very interested in working in a warehouse, high rate of drug test failures, immigration laws and a highly competitive environment.”

That’s why many of today’s automated storage and retrieval systems (AS/RS) are equipped with automation, flexibility and efficiency.

Automation is key to the future of AS/RS

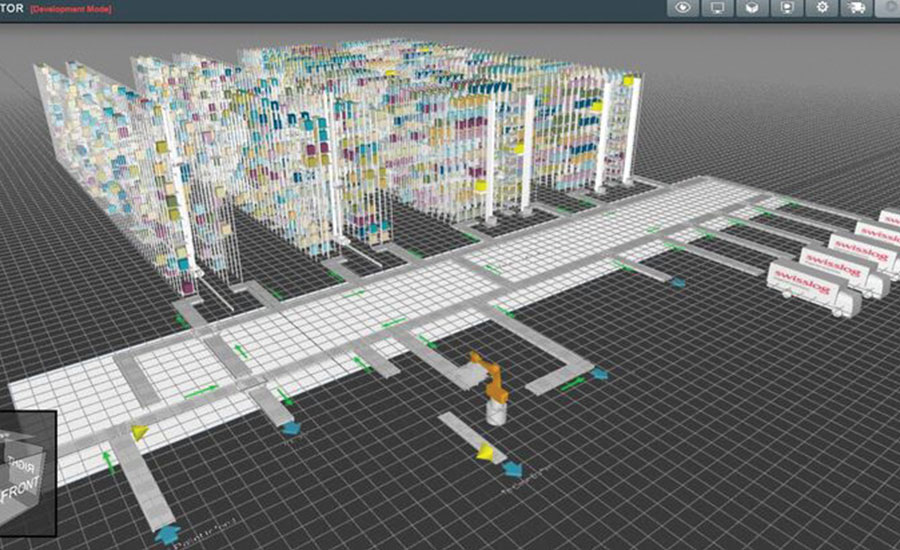

In the past, the term AS/RS was used to describe cranes and case shuttles, however now it relates more to autonomous vehicles, modular racking systems and pallet shuttle systems, says TJ Fanning, vice president of consumer goods, Swisslog North Americas.

To help the food and beverage industry future-proof their operations, so to speak, the Newport News, Va.-based manufacturer developed a portfolio of solutions, including Swisslog SynQ software, which is an Industry 4.0-ready roadmap that regularly integrates new functionality and benefits.

“Some great examples would include the freezer-rated PowerStore, which has the ability to capture temperature automatically across all rack locations to find inconsistencies in your facility,” Fanning adds.

Other Swisslog solutions entail AutoStore, a flexible solution that maximizes storage density and automatically slots items for maximum throughput.

Rack & Roll developed an AS/RS that’s equipped with patented FloatingAisle technology, which allows 90% utilization of floor space and provides nearly instant access to any pallet in the warehouse at any time.

Cyclone Carrier is a high-speed case shuttle solution that provides rapid access to all items.

Tornado is a mini-load crane solution that provides immediate access to all cases with a variety of load handlers.

Vectura is a pallet/large load crane solution that supports installations up to 50 meters in height.

PowerStore is a pallet shuttle solution that provides high-speed pallet retrieval in freezer applications.

And, CarryPick is an autonomous vehicle that utilizes modular racks to bring entire racks of product to operators and/or storage. CarryPick’s automated guided vehicles (AGVs) continuously supply workstations with mobile racks. This flexible new approach provides the ability to add racks and AGVs quickly as storage volume increases, and enables equipment to be easily moved from one warehouse to another. The CarryPick system’s new KMP 600 AGV was developed in close collaboration KUKA, Germany.

“The customer-driven ‘fresh’ delivery expectation requires the use of automation to minimize the number of touches and time in the logistics networks while using vision systems to maximize quality of product,” adds Fanning.

In September 2017, AutoStore, a Norway-based provider of grid-based, scalable warehouse automation system, signed a strategic agreement with Dematic to enable AutoStore’s high-density storage and goods-to-person picking systems to become part of Dematic’s supply chain optimization solutions portfolio. As a result, Dematic offers, configures, engineers, installs and supports AutoStore as a sub-system within its overall supply chain installations or as a stand-alone storage and fulfilment solution.

“AS/RS technology will be utilized in almost all aspects of the operation, from receiving and storing pallets, layer picking, case and each picking, replenishment, shipping and returns,” says Steininger.

Additional AS/RS features such as automation enhancements via smart devices offer means for faster reaction time when process interruption occurs, according to John Ashodian, market segment manager, logistics automation for SICK, Inc., Minneapolis. Sensors can be used to monitor the status of systems in a production or distribution process, and send alerts when performance parameters fall out of place. Data availability and security controls enable operators to make better, more informed decisions. And, smart connected sensing devices integrated with AS/RS enhance functionality and provide overall greater autonomy.

“Automation is enabling greater production control for the manufacturer and distributor,” adds Ashodian. “The amount of data that is made available through Industry 4.0-ready solutions and IoT helps both ends of the supply chain since information is more flexible and available. This ultimately leads to faster cycle times in production and more efficient delivery of goods to the consumer.”

Rack & Roll, Inc., Edgewater, Fla., developed an AS/RS that’s equipped with patented FloatingAisle technology, which allows 90% utilization of floor space and provides nearly instant access to any pallet in the warehouse at any time.

Swisslog SynQ software is an Industry. 4.0-ready roadmap that regularly integrates new functionality and benefits.

“Food miles, clean products, online ordering and distribution, energy costs, and of course, automation [are driving today’s food and beverage processing and distribution market],” says Isaac Cronin, chief marketing officer. “Our system, with its easy introduction of fixed digital pathways, accommodates and encourages autonomous forklifts and other robotic devices that exist now and will be introduced in the coming years.”

Cimcorp, Canada, presented its 3D Shuttle machine, which uses gantry robot technology integrated with an innovative shuttle device to store and retrieve goods in plastic crates, totes, bins and containers. The simple, scalable and movable robotic system is easy to install and maintain, is said to be up to six times more efficient than manual solutions and boasts the capacity to pick up to 1,000 totes per hour.

Meanwhile, Stoecklin Logistics, Inc., Atlanta, introduced the FSP Shuttle to the North American market. The FSP can go up to 25 meters high, and move product as heavy as 110 pounds from level to level in temperatures as low as -22°F. Additionally, the extractor on the FSP vehicle has the ability to retrieve totes and containers as large as 860x660x500 mm up to four deep to either its right or left. Visualization and statistical functions give a direct insight, thus enabling proactive maintenance.

“We are looking forward to the positive impact that the FSP will have for Stocklin’s customers,” says Urs Grütter, chief executive officer, in a press release. “Deep freeze functionality and large carton handling have been requested for quite some time in a shuttle.”

Overcoming next-generation barriers

Digital technologies and innovations are driving massive changes and improvements in supply chain. Meanwhile, digital disruption and continued globalization are stretching supply chains to the farthest reaches of the planet, putting supply chains under more stress than ever before, according to “Overcoming Barriers to NextGen Supply Chain Adoption,” a survey report produced by MHI, Charlotte, N.C., and Deloitte Consulting LLP, New York.

This annual industry report provides an up-to-date perspective on emerging supply chain trends, including the critical shift toward next-generation (NextGen) digital supply chains and the real-world impact of key innovations on supply chain operations and strategies.

The top technologies respondents say can be a source of either disruption or competitive advantage are:

- Robotics and automation (65%, up from 61% in 2017)

- Predictive analytics (62%, up from 57% in 2017)

- Internet of Things (IoT) (59%, up from 55% in 2017)

- Artificial intelligence (53%, new category in 2018)

- Driverless vehicles and drones (52%, up from 30% in 2015)

Cloud computing and storage maintain the highest current adoption rate at 57%. Adoption is expected to grow to 91% over the next five years. Inventory and network optimization, now at 44% adoption, are expected to grow to 90% over the next five years.

"Stoecklin Logistics introduced the FSP Shuttle, which can go up to 25 meters high, and move product as heavy as 110 pounds from level to level in temperatures as low as -22°F."

Over the same timeframe, predictive analytics is expected to reach an 82% adoption rate, followed by IoT at 79%, robotics and automation at 73%, blockchain at 54%, driverless vehicles and drones at 50% and artificial intelligence at 47%.

The Top 3 barriers to adoption of these technologies are:

- Making the business case for NextGen supply chain investments.

- Tackling the supply chain skills gap and workforce shortage.

- Building trust and security in digital, always-on supply chains.

To implement any of these technologies, firms need access to a skilled and increasingly digital supply chain workforce.

The top critical skills needed to compete in the NextGen supply chain, according to the survey, are strategic problem solving (49%), analytics/modeling/visualization (43%) and general business acumen and cross-functional knowledge (38%).

When it comes to cybersecurity, the sophistication of hackers and “threat actors” is the biggest risk (44%), followed by the lack of awareness of the threat within the organization (40%) and poor cybersecurity practices among suppliers (37%).

Future of on-demand economy

While labor shortage, undesirable working conditions and rapid technology enhancements continue to challenge the food and beverage industry, the future of an on-demand economy poses a different way of doing business—more SKUs, additional channels of distribution, growing consumer demand for same-day delivery.

In response to today’s online-buying consumer that expects a seamless, faster purchasing journey, the “Future of Fulfillment Vision Study,” produced by Zebra Technologies Corp., Lincolnshire, Ill., revealed that 78% of logistics companies expect to provide same-day delivery by 2023 and 40% anticipate delivery within a 2-hour window by 2028. In addition, 87% of survey respondents expect to use crowdsourced delivery or a network of drivers that choose to complete a specific order by 2028.

“Driven by the always-connected, tech-savvy shopper, retailers, manufacturers and logistics companies are collaborating and swapping roles in uncharted ways to meet shoppers’ omnichannel product fulfillment and delivery expectations,” says Jim Hilton, manufacturing, transportation and logistics global principal. “Zebra’s Future of Fulfillment Vision Study found that 89% of survey respondents agreed that e-commerce is driving the need for faster delivery. In response, companies are turning to digital technology and analytics to bring heightened automation, merchandise visibility and business intelligence to the supply chain to compete in the on-demand consumer economy.”

The survey found reducing backorders was the biggest challenge to reaching omnichannel fulfillment for one-third of respondents followed by inventory allocation and freight costs.

Although 72% of today’s organizations utilize barcodes, 55% are still using manual pen-and-paper-based processes to enable omnichannel logistics. By 2021, handheld mobile computers with barcode scanners will be used by 94% of respondents for omnichannel logistics.

Radio-frequency identification (RFID) technology inventory management platforms are expected to grow by 49% in the next few years.

Future-oriented decision makers revealed that next generation supply chains will reflect connected, business intelligence and automated solutions that will add newfound speed, precision and cost effectiveness to transportation and labor. Surveyed executives expect the most disruptive technologies to be drones (39%), driverless/autonomous vehicles (38%), wearable and mobile technology (37%) and robotics (37%).

The need for inventory accuracy will continue to rise in North America, according to the study. Manufacturers, logistics companies and merchants ranked current inventory accuracy at 74%, and reported needing to be at 83% to handle the rise of omnichannel logistics.

Future-proofing the supply chain

From illuminating education to next-generation technology and equipment in action, MHI’s MODEX 2018, which took place April 9-12 in Atlanta, connected over 850 leading providers to showcase key industry trends and innovations designed to “future-proof” supply chains.

Click here to check out the latest in automated, robotic, AI-enabled AS/RS.