Fresh and frozen meal kits and convenient sides and snacks are changing the way we cook dinner and creating new opportunities for food manufacturers and processors.

The meal kit delivery service market is poised for significant growth, according to Future Market Insights, a global provider of market intelligence, advisory services and consulting. Driven by the demand for home-cooked meals and the convenience of meal kits and subscription models, meal kit delivery has an expected compound annual growth rate (CAGR) of 14.6% over the next decade, for a forecasted market value of over $65 million by 2033.

Home Chef, Factor and FreshRealm are among the meal solution companies making investments in infrastructure to meet growing demand.

“As retailers look to capitalize on evolving consumer behavior by expanding their fresh prepared meal offerings, production costs may be a shell-shocking deterrent. In-house assembly requires costly labor commitments from employees across functions and levels – from store teams that assemble, package, and stock meals, to planners that develop and source innovative recipes, to marketers that merchandise offerings across channels,” said Rob Law, chief revenue officer at FreshRealm.

FreshRealm last year raised $200 million in capital to help it spur expansion and provide private label mealtime solutions and Kitchen Table, its first branded line, for retailers including Amazon Fresh, Kroger, Publix, Meijer and Walmart.

This spring the company purchased the operational infrastructure of Blue Apron. They are expanding the national operational and production footprint to nearly 1 million square feet via three facilities, including a new production site in Lancaster, Texas, just outside of Dallas. (The company acquired facilities in Linden, New Jersey, and Richmond, California, from Blue Apron).

“This increased capacity will allow FreshRealm to continue to address the growing omnichannel retail environment and rising consumer demand for quality, value-driven and consistent fresh meals,” Law said. The facility located outside of Dallas in Lancaster, Texas further extends the company’s reach, reaching more than 95% of the U.S. population in just 10 hours. The strategic locations will also ensure delivery within 24 hours of meal assembly to maximize the shelf life of the company’s product lines.”

A 2022 FreshRealm consumer insights survey found nearly 40% of respondents said they opted for one to three prepared or semi-prepared breakfast and lunch options each week, and almost a quarter of shoppers report paying more frequent visits to the fresh meals section of their grocery stores since the pandemic began, according to the Food Marketing Institute (FMI).

Home Chef this summer opened a 170,000-square-foot production and distribution facility in Baltimore, Maryland, its first production location on the East Coast. The facility is Home Chef's largest by volume, accounting for more than 30% of its meal solutions delivered nationwide.

And, last month, the company launched a new ready-to-heat meal brand, Tempo, which focuses on single-serve, microwaveable meals that are ready in minutes and made with nutrient-rich ingredients.

Factor, one of America’s leading ready-to-eat (RTE) meal delivery services, this fall opened a new 300,100-square-foot production center in Goodyear, Arizona.

Since its acquisition in 2020, by the HelloFresh Group, Factor has grown its consumer base and increased its menu offering by 75%, enabling consumers to choose among a wider selection of meals, including more keto, calorie smart, protein-plus, vegetarian, and vegan dishes.

Plant-based and options for flexitarians continue to expand, with Amy’s Kitchen and Vegan Sunday Supper rolling out new mealtime solutions.

Salad kits continue to be a source of product innovation, with P.F. Chang’s, Dole and Fresh Express launching new salad kits this year. Local Bounti in June became the first indoor grower to offer salad kits with chicken.

Convenient side dishes are being developed to accompany main dish proteins, like Dole’s Sheet Pan Starter Kits, inspired by viral sheet pan meals on social media and designed to fill a need for single-pan meal options in the value-added vegetable category.

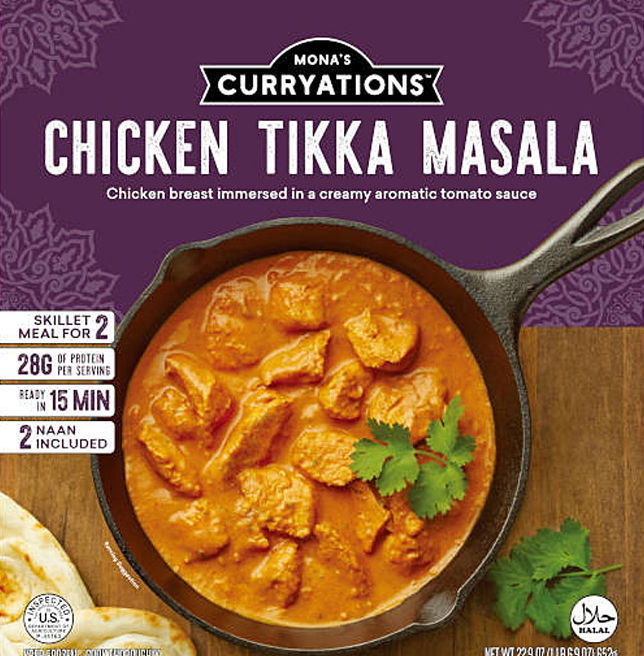

Other items like Two Fish seafood boil bags, Mona’s Curryations and Afia are bringing diverse flavors to freezers.

“We continue to see demand for homemade foods such as elevated comfort foods, for global ingredients from spices to peppers and flavors such as BBQ, Honey Garlic, Bergamot and Apple Butter,” Law said.

Future Market Insights predicts the U.S. isn’t the only market to expect growth in meal kits. The Japanese market is predicted to grow at a CAGR of 9.7% from 2023 to 2033. Rapid growth is anticipated also in France (9.2%), Germany (8.4%) and the United Kingdom (7.8%)