Cost-conscious consumers, stepped-up innovation and distribution gains provided a lot of momentum for private label brands in the early 2000s. However, the stronger economy, falling food prices and the maturation of some important private label sectors are putting the squeeze on this momentum, which has stalled in the past five years and even began to decline in 2015, according to a study produced by Chicago-based IRI.

The latest IRI Times & Trends report, “Private Label: The Journey To Growth Along Roads Less Traveled,” takes a closer look at how consumer packaged goods retailers and manufacturers can strike the right balance between national and private label brands and provide shoppers with the value and quality they desire.

“Relying on distribution to drive consistent growth is no longer feasible, and we’re seeing this in recent growth and share changes,” says Susan Viamari, vice president of thought leadership. “Private label is entering the next phase of its evolution, and there is significant opportunity for retailers if they invest the time and resources needed to raise their private label game.”

The next wave of growth

This past year has seen some noteworthy shifts in channel-level private label trends. Grocery, club and convenience channels were able to maintain solid footing—even slight growth—in private label share, supported by careful expansion of product assortment across food and beverage and non-food ranges. However, private label lost ground in the dollar channel due to strong pricing headwinds. And, the drug channel struggled to maintain private label unit share, losing ground across private label edibles such as cookies.

Taking a closer look across department-level private label share trends provides a glimpse into what’s next for private label. Retailers and private label manufacturers are looking for opportunities to build momentum, and some progress is being made.

“This type of forward-looking thinking and shopper-centric focus is essential to reinvigorating struggling private label sectors and activating new growth levers,” adds Viamari.

Keys to success

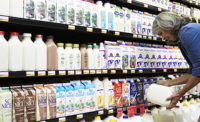

Striking the right balance between private label and name brands is the key to successfully providing a solid value proposition and a positive shopping experience for consumers. National brands drive traffic and variety, and manufacturers continue to excite consumers with innovative new products that are backed up by essential marketing programs. On the other hand, private label brands are critical to a retailer’s value image, supporting margin and profitability. And, when used effectively, private label products offer exclusivity and drive increased customer loyalty. Striking the all-important balance between both offerings comes down to tailoring the product assortment and targeting customers.

The latest report provides high-level insight into how retailers and manufacturers can strengthen their private label portfolios, and also provides strategies that will spur private label growth, including:

- Upstream innovation—Breathe new life into mature private label categories.

- Outside-the-box innovation—Ride the wave where private label growth is escalating.

- Effective price-pack architecture—Provide appropriate breadth and depth of assortment where private label is mature and/or differentiation is challenging.

“It is such an important time in the evolution of private label brands, so this new research is the first installment in private label analyses that IRI will be providing throughout 2017,” adds Viamari. “The initial step is for retailers to understand that they have an opportunity to shine, better serve their customers and strengthen customer loyalty. Establishing organic and sustainable private label growth requires some nitty-gritty planning and solid execution. But, the rewards of getting private label right will be sweet.”