Private label has traditionally responded much like the ebb and flow of the tides. Its strengths vary with economic conditions, and it benefits when the economy is in a recession and suffers during periods of economic growth.

Despite improved quality, large price gaps, retailer marketing, European pressures (7 countries with more than 40% private label share) and retailer consolidation, private label share in the United States has barely budged.

However, private label share today in CPG food is nearly identical to what it was in 1980, according to a report published by Cadent Consulting Group, Wilton, Conn.

The study, “Sea Change for Private Label,” outlines Top 7 reasons for influx in private label sales:

- Amazon and Whole Foods. The Amazon and Whole Foods combination could yield an incremental 2.0 share points for private label in the CPG food market over the next 10 years. Analysis of traditional CPG manufacturer margins vs. retailer margins supports that manufacturer margins are 2-3 times greater on average. There is a clear opportunity for Amazon to tap into these margins. With the expected addition of Whole Foods, Amazon will leverage this acquisition, in part, as a private Label accelerator. For example, Whole Foods’ 365 brand exudes trust, transparency, cleanliness and simplicity. In combination with Amazon, there is an opportunity for significant private label acceleration. Additionally, Amazon/Whole Foods synergies will drive organic/natural/premium/specialty growth where private label development currently lags.

- Millennials. Millennials are often cited as being brand agnostic, but perhaps they just haven’t been educated. If you ask a Millennial about a center store brand, the odds are about even that the individual has never heard of it. Brand marketers have been cutting back on traditional media for years. As a result, Millennials have no real preference between private label or national brands and are far more interested in transparency, clean labels and like-minded values. Millennials will grow to represent the largest percent of purchasing power over the next decade, and they are more receptive to private label products than Baby Boomers. By 2027, there will be 15 million more Millennials than Boomers. Given a 12-point (30%) private label preference, this could yield a 6-point private label share advantage (vs. a 17.7 total share) for Millennials or a 1.5 share point gain across the total population.

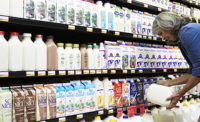

- Perimeter power. The growth in the perimeter has been dramatic over the past 5 years, in fact, 4 times the rate of center store. Compounding this issue is that perimeter categories are far more private label-oriented. Cadent’s assessment of the Top 20 food categories split between perimeter and center store indicates a 20-point share advantage for private label in perimeter vs. in center store.

- 21st Century deep discounter dynamics. According to this report, 90% of private label share resides at Aldi, Batavia, Ill., with Lidl, Arlington, Va., not far behind. These are new 21st century deep discounters in the United States with a holistic commitment to private label.

- Retailer reaction–traditional. If you want to differentiate and drive loyalty, you need to have a quality private label offering. Grocery, mass and club could contribute an estimated 1.5 incremental share points to total private label over the next 10 years. Beyond the changing retail dynamics, retailers are now staffed by leading-edge brand managers, with superior customer databases that can target shoppers through digital communications. Comparable store sales are flat, and a strong private label can be a critical differentiator.

- New entrants. BRANDLESS, San Francisco, is the newest entry to private label, but there are more to come. With an inventory of targeted categories and items all priced at $3, BRANDLESS is leveraging the intersection of transparency/sustainability/organic/private label/e-commerce.

- Private label is a true brand. When a shopper arrives at an intersection, how does one decide? With national brands universally stocked, stagnant growth, lack of innovation and competitive pricing, what is the X factor? Increasingly it is about the store brand, house brand or simply put, private label, which can tier up, tier down, go sideways or simply out-perform and out-innovate with the backing of large, powerhouse retailers. This is the X factor that could be the key differentiating element in the next decade.

Global warming has hit the CPG industry, and private label seas are rising. In fact, private label has reached new heights in a time of relative economic strength. This study displays that private label can represent $64 billion of growth within the next 10 years.

Now is the time to reassess core competencies and target where you can have a true competitive advantage.

- Double-down. Realize that you are a consumer marketer, but it’s not just about the brand, it’s about engagement. The relationship that your shoppers have with your brand and the brand experience is what matters. Marketing is what you do and you need to do it best. What’s the best pricing strategy vs. private label? How should you promote? What messages will turn your consumers into brand advocates? What’s the best approach to merchandising and assortment for you and your retail partners?

- Bifurcate. In theory, this represents the best of both worlds, but is by far the most perilous. While the benefits of potential synergies of producing both branded and private label offerings could accrue from a manufacturing, distribution and retail marketing perspective, most often this complexity overwhelms an organization. A dual national branded/private label approach should only be selectively employed.

- Reinvent. If you’re great at manufacturing and you’re truly a low-cost producer, position yourself as a strategic source. Develop alliances, continue to innovate and recognize the complexity of private label with numerous brands, labels and variations.