What does the new normal look like, and when does it become the new normal?” That’s a question that could apply to any number issues around the world right now, but it was rhetorically asked by Jeff Rumachik, EVP & COO of the National Frozen & Refrigerated Foods Association (NFRA) on a recent From the Cold Corner Podcast. Rumachik is referring to COVID-19’s impact into every aspect of the cold chain in 2020.

The cold foods industry and its supply chain are still recovering from the one-two punch of consumer stockpiling in March and April which emptied store shelves like the ones you see on the cover of this issue, and the shutdown of restaurants, bars, hotels, catering, and other volume foodservice venues, which ground approximately one-third of the country’s food supply to a halt, throwing logistics into chaos.

The current new normal is likely what happens to be successful in the moment, as those along the cold chain continue to navigate the choppy, unpredictable waters left in the wake of coronavirus. Here, we’ll pause to take a mid-year snapshot of several cold chain concerns, but we’ll have to wait for the pandemic to play out for a definitive answer to Rumachik’s question.

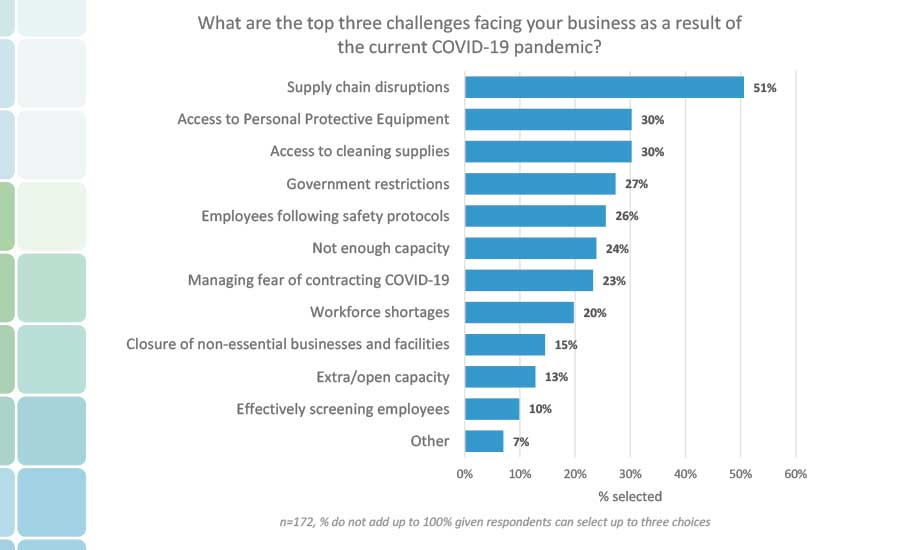

The Global Cold Chain Alliance (GCCA) 2020 COVID-19 Cold Chain Business Impact Survey showed supply chain disruptions as the top concern among operators at the onset of the pandemic.

Logistics and Cold Storage

COVID-19’s effect on the cold storage community was immediate once coronavirus-related panic buying rippled through the cold chain. There has never been a true shortage of food throughout this crisis, but the retail hoarding that ensued in March put the regular flow of goods, food or otherwise, into a bottleneck.

“It seems like we’re all dealing with the same problems,” says Josh Knott, president of the Refrigerated Foods Association (RFA) and also president of Knott’s Fine Foods in Tennessee. Knott was a guest on From the Cold Corner in May and detailed the frustration for operators who had the inventory to replenish empty shelves but couldn’t get it to their destinations like before.

“We’re producing enough [food] and we’re supplying enough, but maybe they [retailers] don’t have the transportation or trucks to get our items into their stores so the shelves are empty because they’re filling up their trucks with things like toilet paper,” Knott says. “A lot of times stores can have empty shelves not because of the supplier but because the retailer doesn’t have the logistics to get it there.”

When foodservice business plummeted due to restaurant shutdowns, distributors like Sysco offered tools and training for restaurateurs reopening in a COVID-19 world. Pictured is Sysco’s online Restaurant Readiness Tool with an immersive 360° walkthrough of a pandemic-prepared space.

The Global Cold Chain Alliance (GCCA) issued their 2020 COVID-19 Cold Chain Business Impact Survey in May based on information from their cold storage members about the effect of coronavirus on their operations. When respondents were asked about actual Q1/Q2 revenue versus Q1/Q2 pre-crisis revenue expectations, 54% reported some type of a decrease, 11% saw no change, and 35% reported an increase in revenue. In addition, respondents believe the next six months may look very similar to the past few months, with 54% believing there will be some type of a decrease, 10% see no change, and 36% believe they will see an increase in revenue.

Worker safety along the cold chain has been another concern with coronavirus. Not just the highly publicized cases of workers testing positive for COVID-19 at food processing plants, but also truck drivers tasked with speedy deliveries of frozen and refrigerated foods to stores, and the people they come in contact with at cold storage facilities and other stops along the way. The GCCA survey shows 90% of respondents put workforce protection as their top priority, followed by maintaining business continuity, and workforce morale. Those companies know business continuity is nearly impossible to maintain if your workforce is sick, so taking measures to protect them also protects your production levels.

A lasting impact COVID-19 will have on the cold chain for the rest of the year and likely into 2021, is a reduction in the number of SKUs to keep the supply chain moving quickly. Before the pandemic, it could be argued the number of SKUs in the food industry was approaching critical mass and was an occasional challenge for the supply chain to maintain. The pandemic made those superfluous SKUs obsolete (for now) in order for more core goods to get to their retail destinations faster. Shoppers for now will see fewer varieties of the same product in stores, but the shelves will be stocked.

Direct-to-consumer (DTC) and e-commerce sales of cold foods were already trending in last year’s State of the Industry Report, but the pandemic made this option a convenient alternative to in-store shopping during shelter-in-place orders, picking up new customers that had never ordered groceries or perishable foods online before. That trend is likely to continue for the rest of the year because of the uncertainty of the pandemic’s next steps. An additional upside for DTC in particular is that companies can offer and directly deliver SKUs of products that may have been cut from retail inventory this year.

Foodservice

Pandemic-driven shutdowns for volume venues like restaurants, bars, hotels, catering, sports arenas, and more, flattened foodservice this year, and had a significant impact on the produce industry, as well as broadline distributors like US Foods and Sysco. Because most foodservice inventory is packaged for volume consumption and not retail sales, that food could not be easily redirected to help fill empty stores at the height of panic buying in March, although the sheer need to refill shelves at that time led to some interesting workarounds, like large proteins being repackaged for retail at stores, or “in some cases, we saw grocery stores that had #10 cans on the shelf,” says Jim Osborne, SVP of customer strategy and innovation at US Foods, who talked about US Foods’ coronavirus challenges on From the Cold Corner in May. “That might not have been a normal occurrence months ago, but over a couple of weeks, consumer buying patterns changed so dramatically that having a #10 can in retail is not as crazy as it may have sounded at one time.”

While restaurants remained closed, both US Foods and Sysco have focused their energy and resources on charitable efforts and donations, and also developed their own programs for helping restaurateurs reopen in a COVID-19 world.

Cold Foods Trends

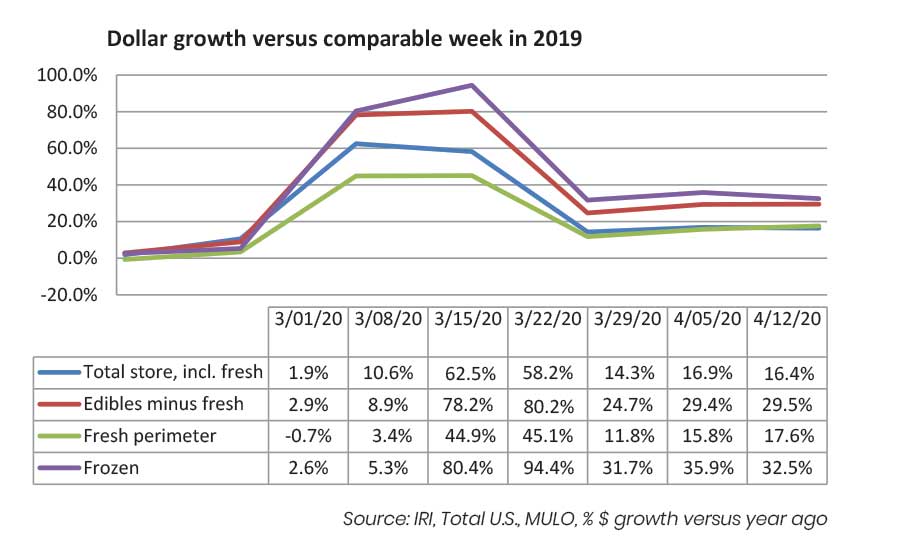

The lack of consumer discretion during the height of panic buying in March and April led to unprecedented, astronomical sales numbers for refrigerated and frozen foods. Two categories that stand out in particular were the year-over-year sales increases for frozen pizza (+117%) and frozen cookie dough (+570.4%) in mid-March. Cold foods sales across the board have been similarly elevated compared to 2019, and frozen food sales in particular are expected to hover around +30% the rest of the year, according to the American Frozen Food Institute (AFFI) and 210 Analytics.

Switching to sustainability, we’ve covered initiatives in-depth along the cold chain this year in our March and May issues, so to see how cold foods processors are implementing renewable energy at their facilities, how they’re reducing production waste, streamlining eco-friendly packaging, and more, just click the months above.

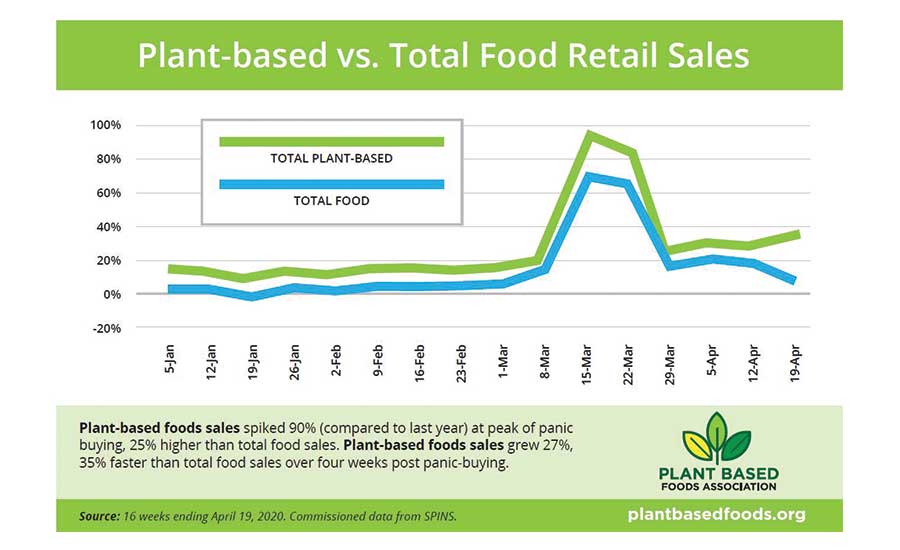

The food category gaining the most momentum—with sales numbers to back it up—is plant-based products. According to May data from the Plant-Based Foods Association, at the height of consumer stockpiling in March, plant-based sales were up 90% compared to 2019, and in the subsequent month afterward, sales growth continued at 27%.

One possible reason for plant-based popularity during the pandemic is the combination of perceived meat shortages from factory shutdowns due to COVID-19, and the subsequent increase in meat prices. However, plant-based foods like alternative meats, milks, yogurts, cheeses and more, were already trending up in 2019, and nearly every major food processor has at least one plant-based product to capitalize on that popularity today. In fact, two of our five Best New Retail Products Winners (P. 26) in this issue are plant-based. The growth is expected to continue well into next year and beyond, as more consumers embrace flexitarian, vegan and vegetarian diets.

The State of Dairy Foods in 2020

Like most cold foods categories, the dairy industry has seen retail sales skyrocket and foodservice sales plummet during the COVID-19 pandemic, which was especially devastating to farmers and processors with enormous amounts of dairy inventory destined for volume foodservice. We sat down with Rachel Kyllo, senior VP of marketing and innovation for the Dairy Farmers of America (DFA) Dairy Brands, to find out how the DFA has handled the pandemic’s challenges and what’s in store for the rest of 2020.

R&FF: How would you describe the state of the dairy industry through the first HALF vof 2020?

Kyllo: Overall, the dairy category has been strong at retail, but has experienced significant declines in the foodservice segment, as a result of the coronavirus pandemic. Many consumer behaviors have shifted amid the pandemic with people eating three meals a day at home, rather than at schools, restaurants or office cafeterias. For example, cereal consumption has increased significantly as more people are eating breakfast at home, which has also had a positive impact on milk consumption. We’re also seeing that consumers are trying to eat healthier since the pandemic began, which is a positive for dairy, as foods like milk, cheese and yogurt provide a unique nutrient profile, including high-quality protein, calcium, vitamin A and more.

Dairy foods were still selling almost 28% higher than 2019 near the end of May this year.

R&FF: What have been the biggest challenges facing the dairy industry regarding COVID-19?

Kyllo: Foodservice declines and away-from-home eating essentially came to a halt with the pandemic, which created challenges for the industry, as some plants and manufacturing facilities were forced to shut down due to lack of demand. Additionally, as the dairy industry is an essential business due to its role in helping feed people, we have been diligently working to continue operating our plants and facilities without disruption. While our number-one priority has been to ensure the safety and well-being of our employees, we’ve also remained focused on maintaining high levels of customer service and ensuring that we’re meeting their needs and demands.

R&FF: What successes has the dairy industry achieved through the first six months of 2020?

Kyllo: We’re seeing sustained milk volumes over the last 8 to 10 weeks, as eating behaviors at home have changed with the pandemic. Shoppers are re-thinking the role that milk plays in their lives, and we’re seeing that milk and other dairy products are very top-of-mind as “must-have” items for consumers. As we look ahead beyond the pandemic, our challenge will be to continue to sustain this at-home growth for milk.

R&FF: What trends do you see in dairy continuing through the end of 2020 and into 2021?

Rachel Kyllo is Senior VP of Marketing and Innovation for the Dairy Farmers of America (DFA) Dairy Brands

Kyllo: Health and wellness continues to be really important for consumers right now, and dairy foods offer a great nutritional profile with protein, calcium and other essential nutrients. Plus, many consumers today are looking for added-value, functional benefits in their foods, so we think we’ll continue to see products with added benefits like probiotics or additional protein. Comfort foods have also made a real comeback with the coronavirus pandemic as people are seeking familiarity and cooking more while staying at home. Dairy foods like milk, cheese and butter play a key role in comfort eating, and we think this shift to cooking more at home is likely to continue, even as restaurants start to open up.

The State of Frozen Food in Retail and Foodservice

As the frozen food supply chain works together to rise to the challenge of feeding Americans during this national emergency, the American Frozen Food Institute (AFFI) is providing key retail and foodservice market insights for business planning.

Frozen Food Sales in Retail

Overall, frozen food sales at retail continue to hold strong with double-digit gains since mid-March compared to a year ago. AFFI has been tracking weekly sales figures, but we wanted to dive deeper into consumer purchasing habits during the pandemic to understand if this increased demand is here to stay.

AFFI’s latest consumer survey “Frozen Food Sales Amid COVID-19,” finds that for new and returning customers, higher satisfaction and “future intent to purchase” both indicate frozen sales will continue to trend higher in the months and years ahead. Here’s a brief snapshot of what we found:

- Majority of Americans are buying frozen food: 86% of all consumers have bought frozen food items, such as frozen pizza, vegetables and entrees, since early March. This includes an equal share of frequent frozen food buyers, as well as consumers who don’t consider themselves regular purchasers.

- The category has added many new customers: 7% of consumers who rarely or never purchased frozen foods pre-pandemic are now buying. This is a tremendous expansion of the category that could have long-term implications. This includes Gen Z buyers, as well as Baby Boomers who left the category during the TV dinner era – returning now to find newer, tastier products.

- Loyal customers are buying more and trying new: In addition to new feet down the aisle, current frozen food consumers are changing up frozen buying behaviors. Our survey found that 70% are buying more than usual and 68% are trying new brands and products.

- It’s more than just convenience: On a five-point scale where five is excellent, convenience received the highest ranking at 4.3, and quality was second, at 4.1. We also know from our previous research that our core frozen food shoppers are also turning to frozen foods for the taste, variety and consistency of the food itself.

- Buyers will come back: 50% of consumers who have purchased frozen foods since COVID-19’s onset say they will purchase a lot more (18%) or somewhat more (32%) in the next few months.

At the height of Mid-March consumer stockpiling, frozen foods were selling +94.4% higher than 2019, with ice cream at +45.4% over last year.

Frozen for Foodservice

According to Datassential, foodservice sales are down an average of 65% across the whole industry, but it’s not the same story for everyone. On-site segments are significantly more optimistic they’ll recover from COVID-19, like healthcare and K-12 foodservice, because they have essential roles to play right now. Restaurants are completely discretionary for all consumers at this point, which is why they’re significantly more worried about permanent closures.

The positive news for frozen in the foodservice segment is that operators are purchasing less frequently and are turning to frozen foods for its longer shelf life which means less wasted food. In addition, the versatility of frozen foods allows the operator to be nimble with their menu options and planning.

What we’re seeing play out for frozen in foodservice is reinforcing what we know: frozen foods are an essential ingredient for the nation’s foodservice operators.

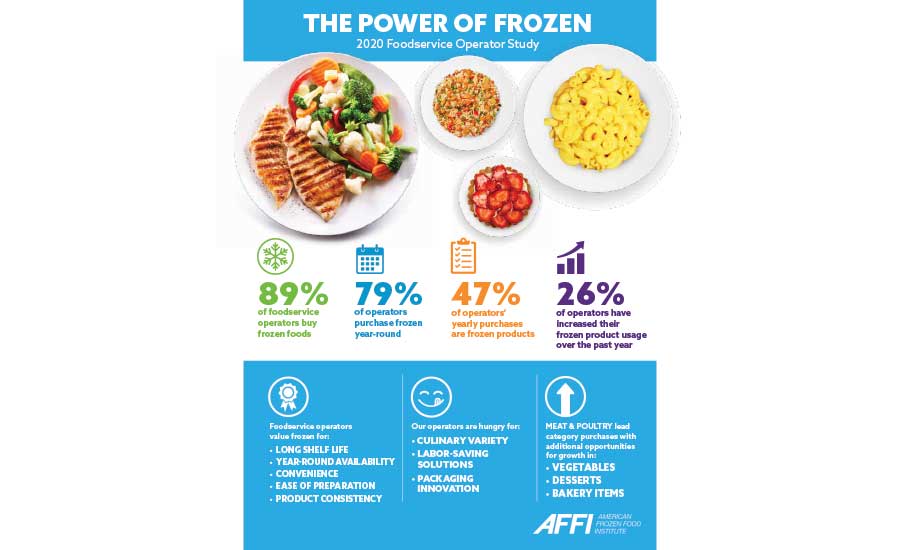

AFFI partnered with Datassential earlier this year to explore operator attitudes and perceptions about frozen foods, purchase drivers and uses, and identify how manufacturers and distributors can most effectively meet operator needs and strengthen demand for frozen food in foodservice.

Despite the frozen category’s high penetration in foodservice (89% of operators purchase frozen foods and beverages), potential for growth exists as operators expressed interest in category innovation. The COVID-19 effect has further driven the need for innovation, specifically last mile delivery. Operators in our survey also expressed the need for category innovation such as:

Alison Bodor is president and CEO of the American Frozen Food Institute (AFFI) in Arlington, Virginia.

- Greater flavor variety with enhanced quality and textures.

- Frozen products that provide labor savings (such as fully prepared frozen items, in addition to understanding the role of frozen in scratch cooking).

- Packaging to address storage limitations and reduce food waste, such as resealable, bulk bags.